AUTOMOTIVE DEALERSHIP AND EMPLOYEE FRAUD

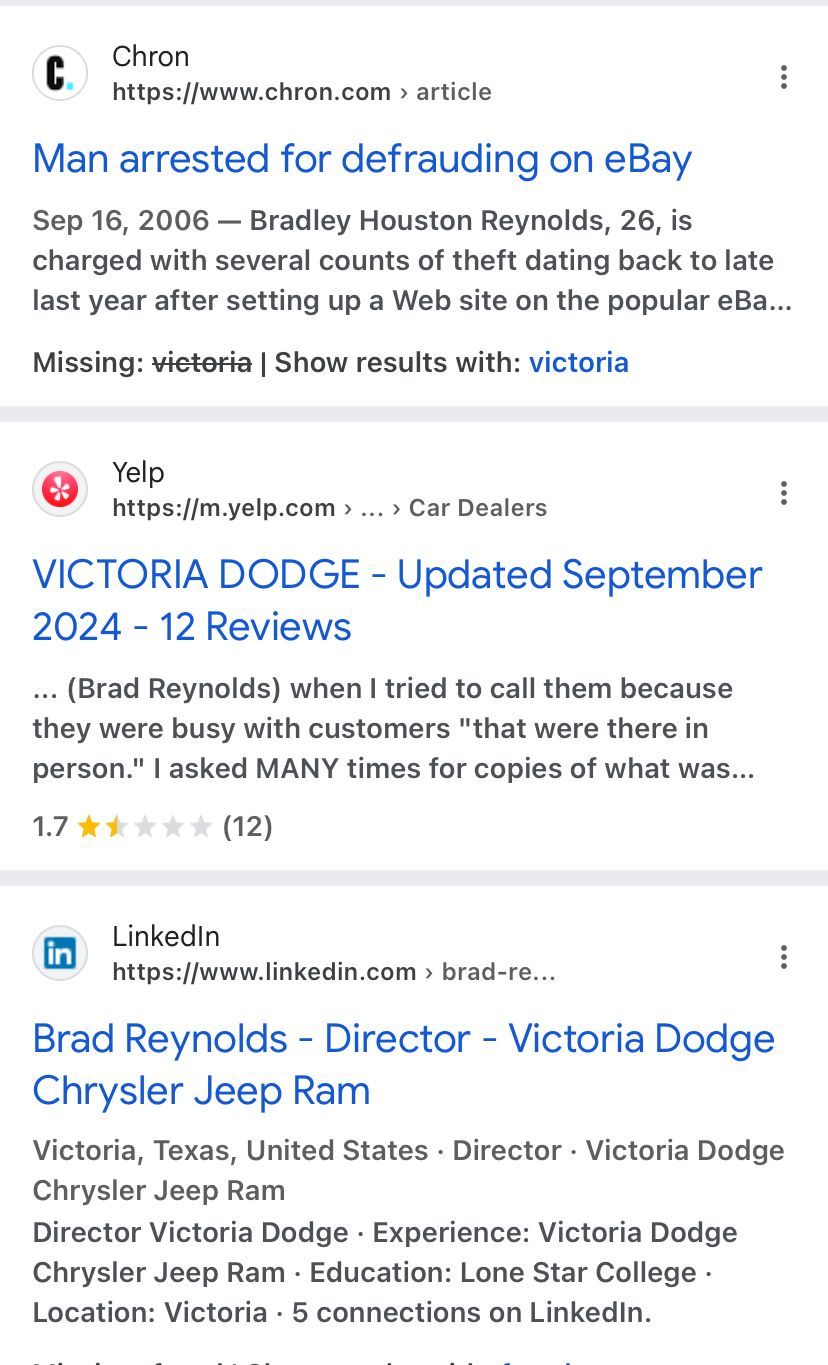

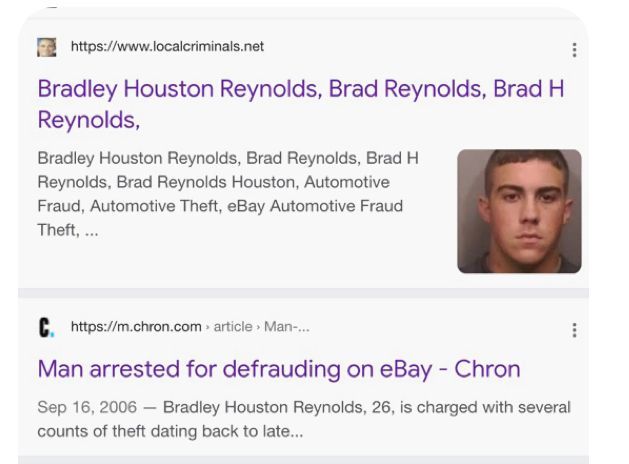

"https://www.chron.com/neighborhood/article/Man-arrested-for-defrauding-on-eBay-9599564.php"

12/29/2025

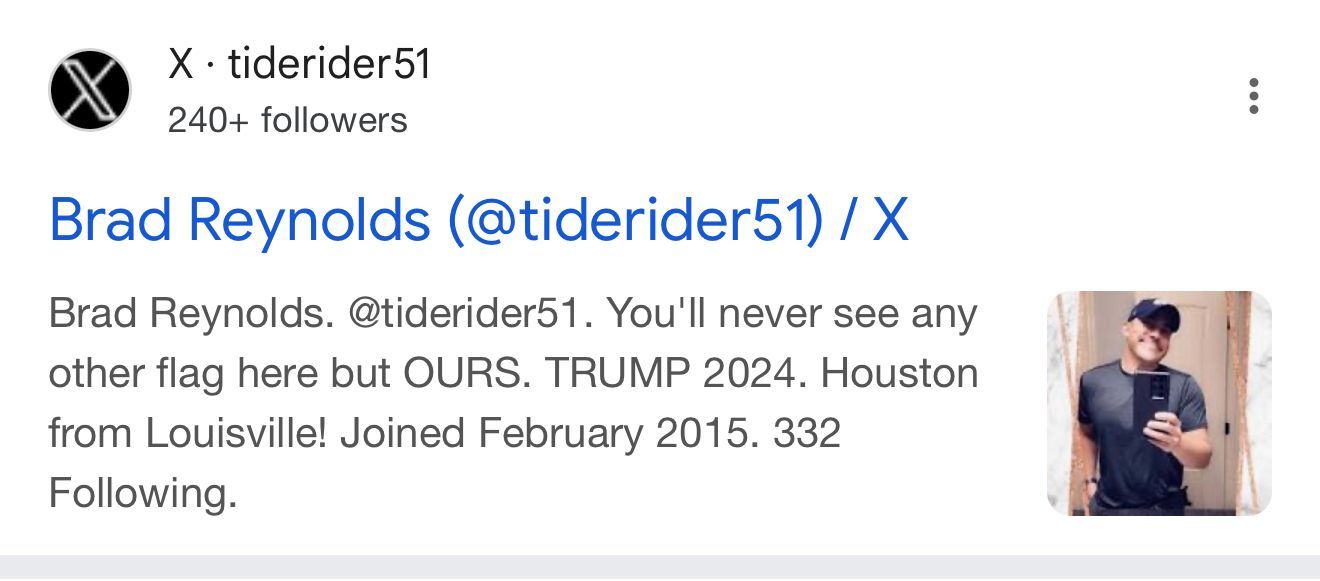

BRAD REYNOLDS @TIDERIDER51 / X

EX-CON

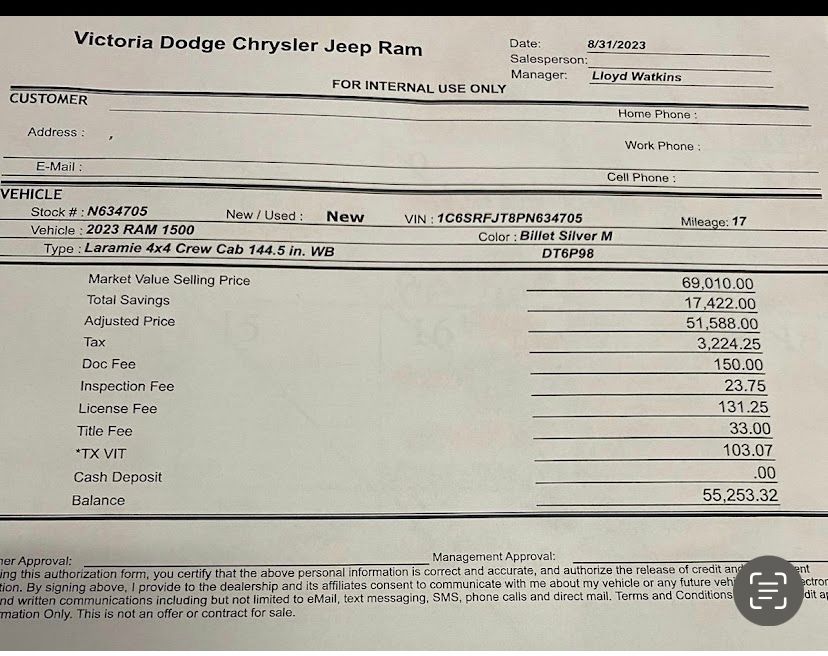

Victoria Dodge Chrysler Jeep Ram Wagoneer

Bradley Houston Reynolds, Brad Reynolds continues his lies and deception.

Continues Finance Department Fraud

At

VICTORIA DODGE CHRYSLER JEEP RAM WAGONEER

No college degree, No Football, incarcerated, 9 years, 8 indictments

100 percent Con Man Public Warning!

Massive Finance Fraud

Request all paperwork at purchase

,

Check for Fake Fees, Fake Signatures, Fraud.

CONTINUED LIE TO DECEIVE THE PUBLIC!

NO FOOTBALL

"Brad Reynolds (@tiderider51) / X"

"https://twitter.com/tiderider51"

"https://twitter.com/tiderider51?lang=en"

(AKA)

BRAD REYNOLDS, BRAD H REYNOLDS, BRAD HOUSTON REYNOLDS, BRADLEY REYNOLDS, BRADLEY H REYNOLDS,

BRADLEY HOUSTON REYNOLDS, TIDERIDER51

GOOGLE, DEALERSHIP

CONTINUES TO REMOVE THIS PUBLIC WARNING

BY ALTERING WEB PAGE INFORMATION AND THE PUBLIC PICTURES

BY INSTALLING CODES TO RESTRICT PUBLIC VIEW

"1920W, 620W"

PUBLIC

NOTICE

WARNING

EX-CON

BRADLEY HOUSTON

REYNOLDS,

BRAD REYNOLDS

Brad Reynolds (@tiderider51) / X

NOW IN DEALERSHIP FINANCE DEPARTMENT

Commits 100 % Fraud in the Finance Department at Victoria Dodge Chrysler Jeep Ram Wagoneer In

Victoria, Texas, as Finance Manager/Director

owned by

Ben Keating Auto Group,

361-333-5089

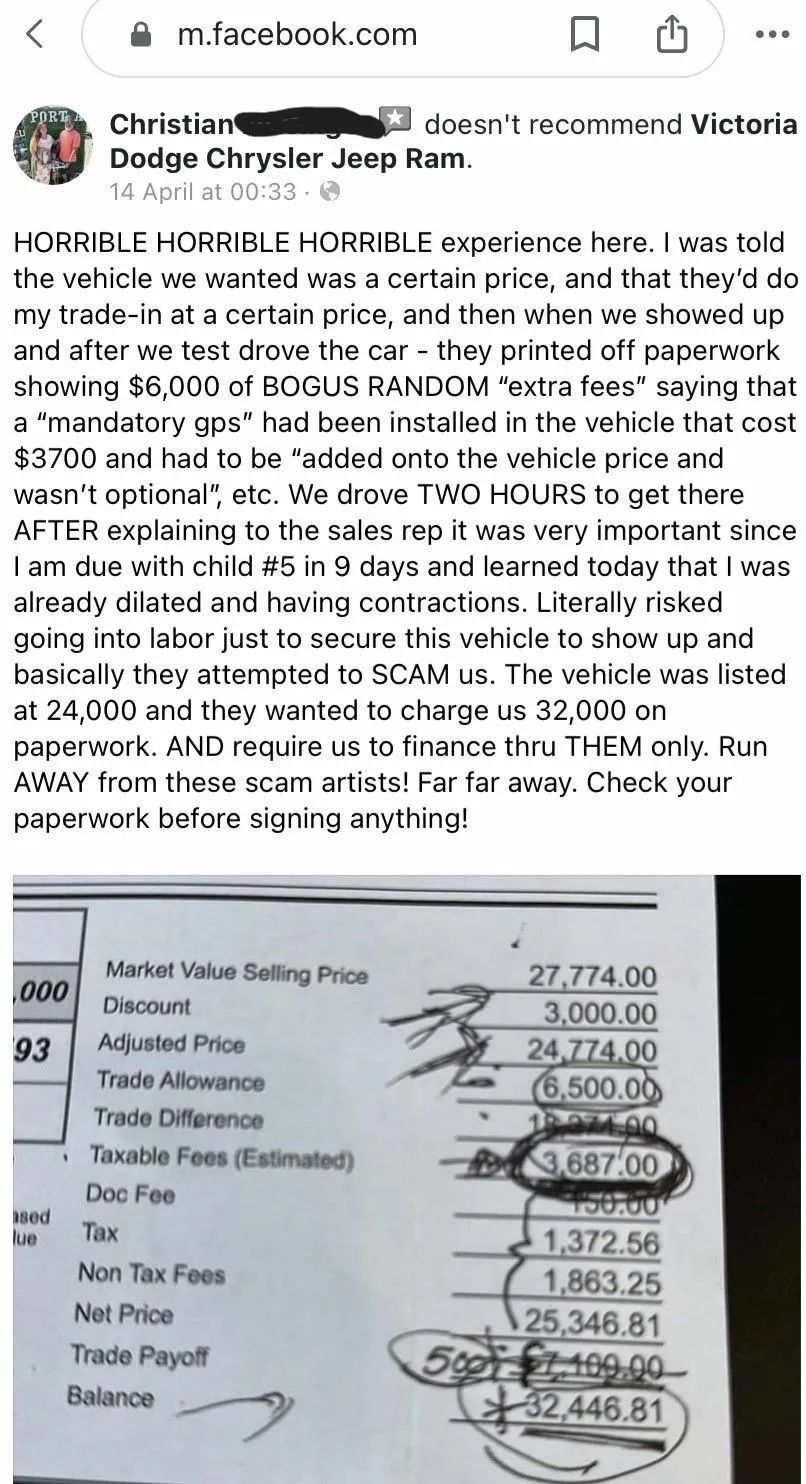

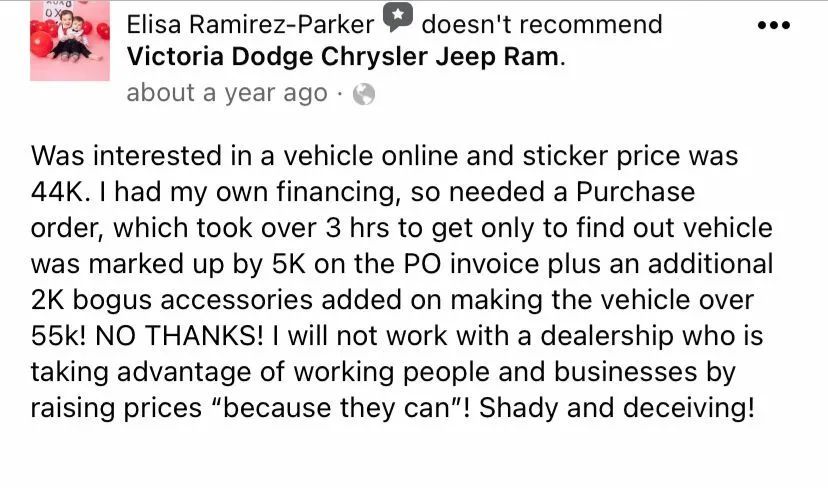

TIED SELLING IS TOO FORCEFUL, MAKE

THE CUSTOMERS PURCHASE A REQUIRED DEALERSHIP NON-DISCLOSED GPS AND

OPTIONAL AFTERMARKET PRODUCTS

TO PURCHASE THEIR DEALERSHIP VEHICLES

100 PERCENT

ILLEGAL

CUSTOMERS

REFERENCE

VICTIMS

DOCUMENTS

BELOW

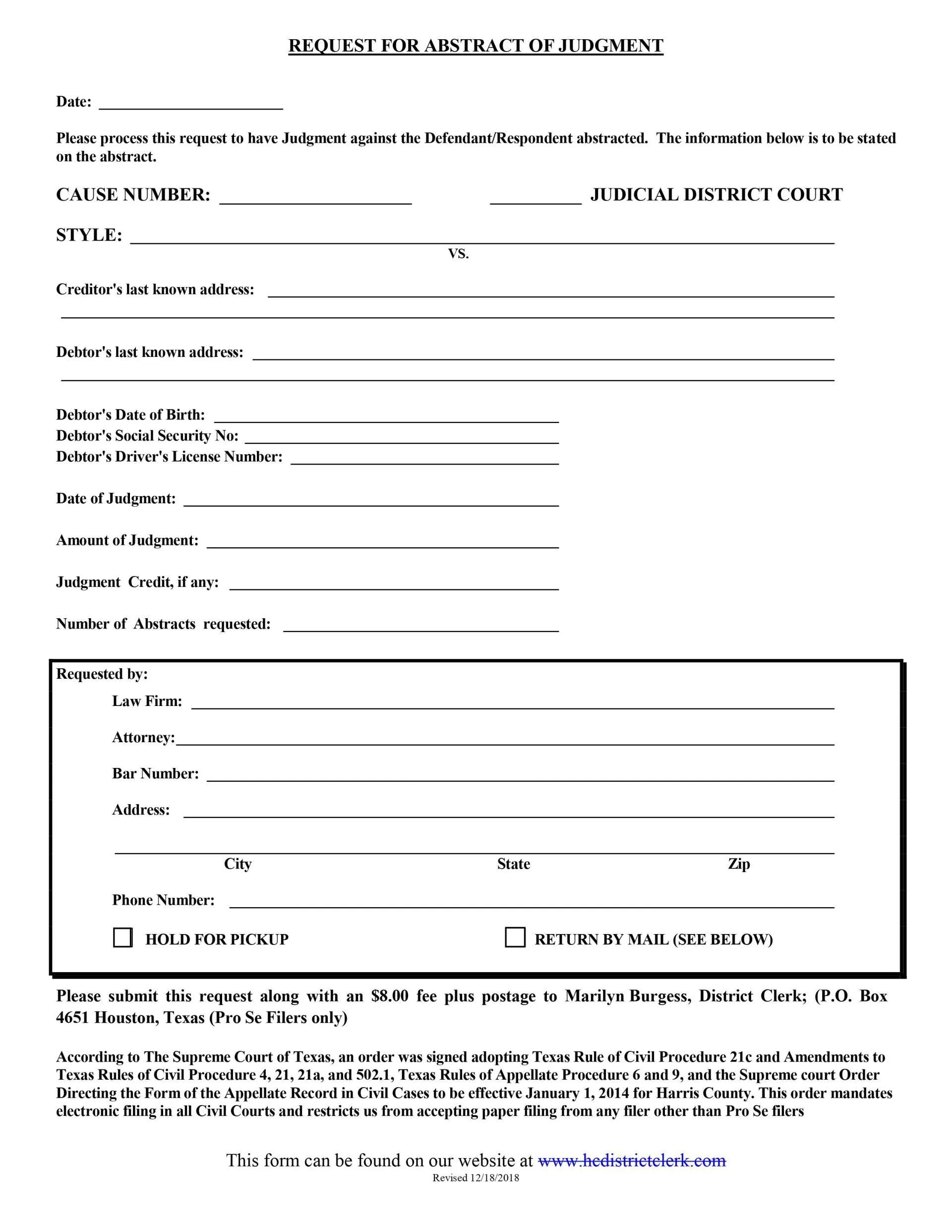

REQUEST YOUR

BUYER'S PURCHASE

AGREEMENT

VERIFY THE AMOUNT FINANCED

WITHOUT OPTIONAL

PRODUCTS

CHECK YOUR FINANCE CONTRACT AMOUNT FINANCED

VS

BUYERS PURCHASE AGREEMENT BALANCE DUE

TEXAS

(CRFA)

Stop Automotive Dealership and Employee Fraud

This is what can happen when

Dealerships no longer require

Employment

Background Checks

Drug Tests

Criminal Convictions Records

or Require Licenses or Certificates

to Sell or Finance Vehicles

or the

SELLING OF After-market ( Optional ) Products

to individuals at dealerships

To hold

Finance Managers, Sales Managers

Finance Directors and

Sales Person Accountable

Dealerships use their corporate

An insurance umbrella policy to avoid disclosure

of their employees

12/29/2025

Victims

of

Bradley

H

Reynolds

Fraud

call

Collections

@

877-249-829-023#

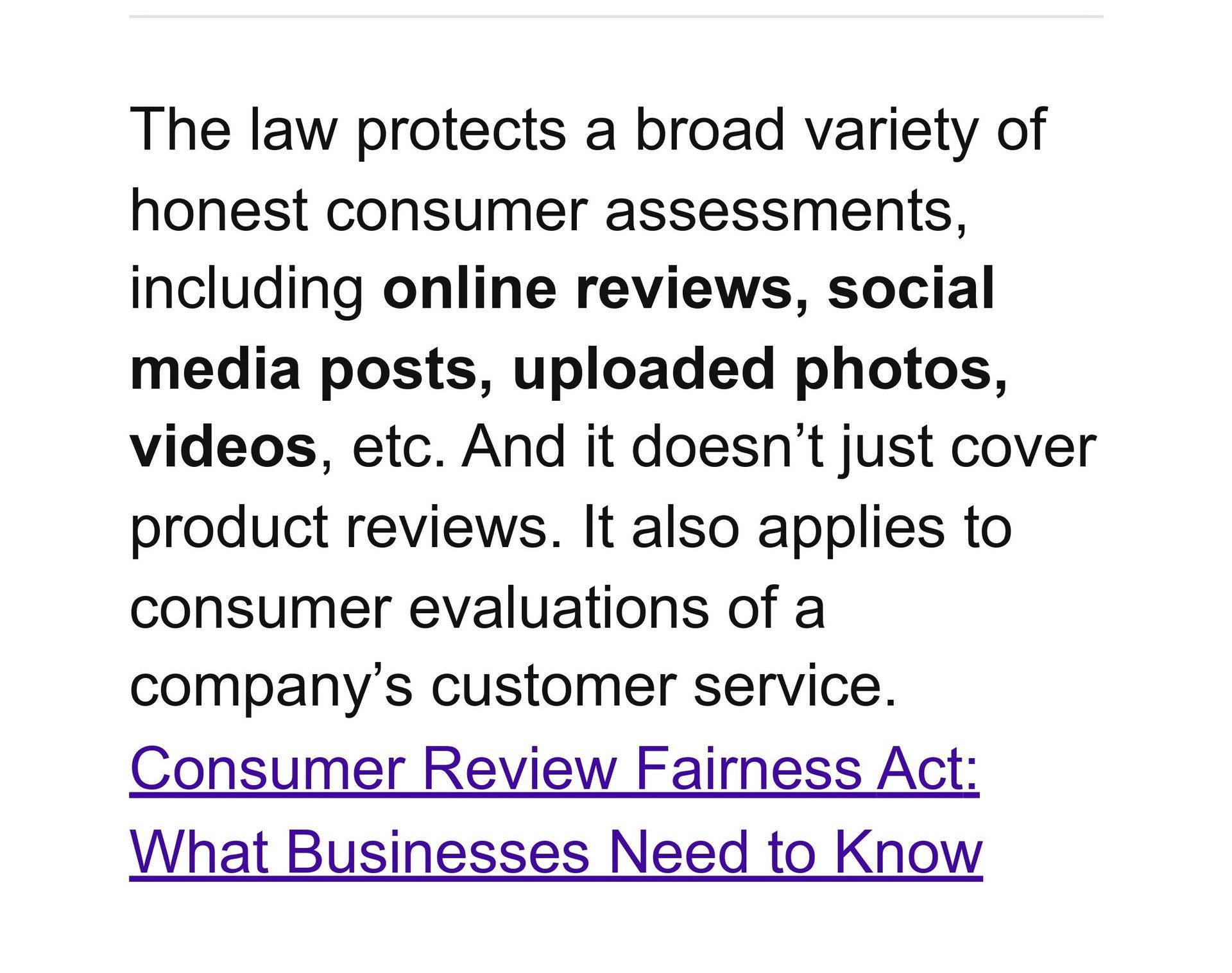

The Consumer Review Fairness Act (CRFA) protects people's ability to share their honest opinions about a business's products, services, or conduct, in any forum, including social media.

https://www.ftc.gov/legal-library/browse/statutes/consumer-review-fairness-act

BRAD REYNOLDS, BRAD H REYNOLDS, BRAD HOUSTON REYNOLDS, BRADLEY REYNOLDS, BRADLEY H REYNOLDS,

BRADLEY HOUSTON REYNOLDS, TIDERIDER51

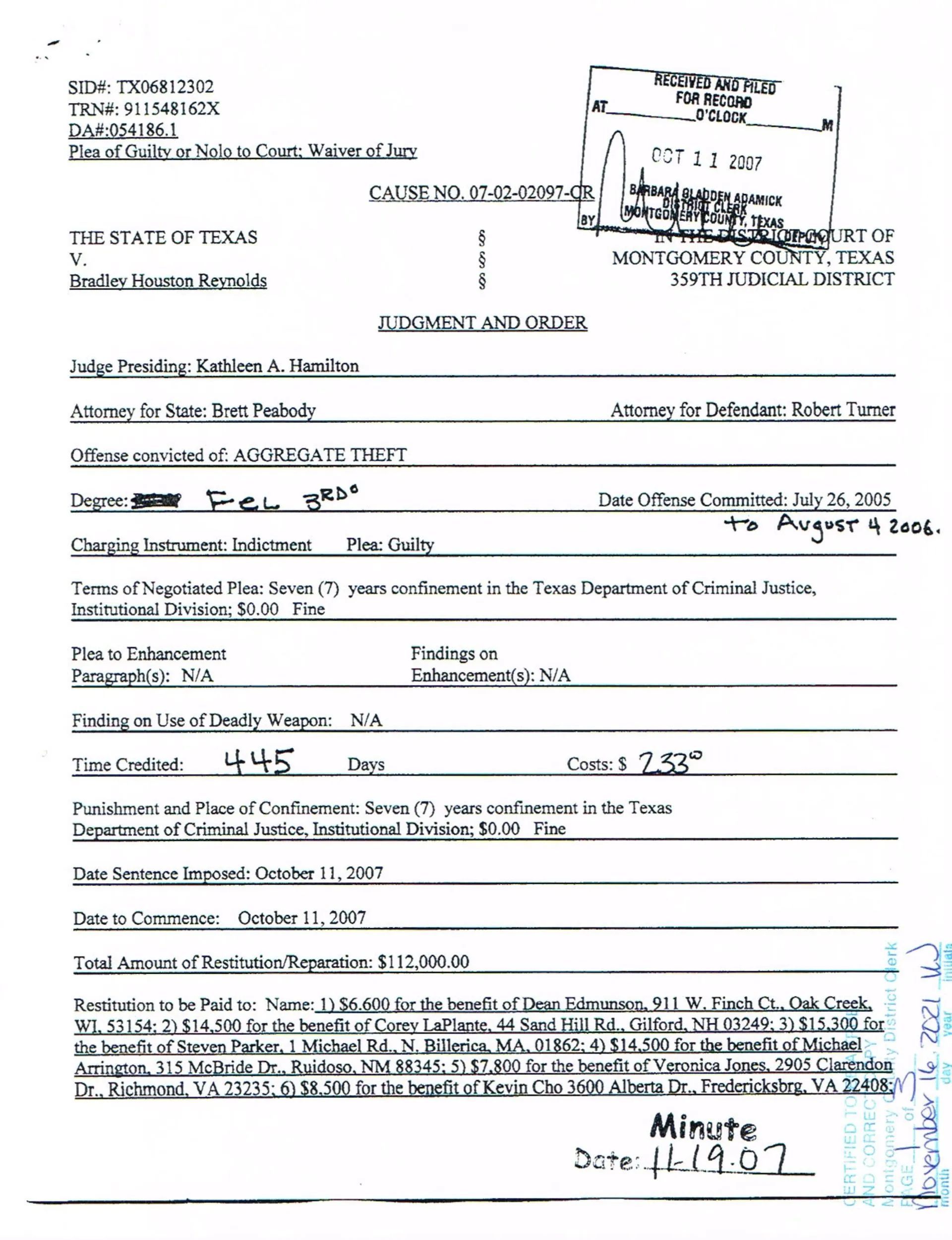

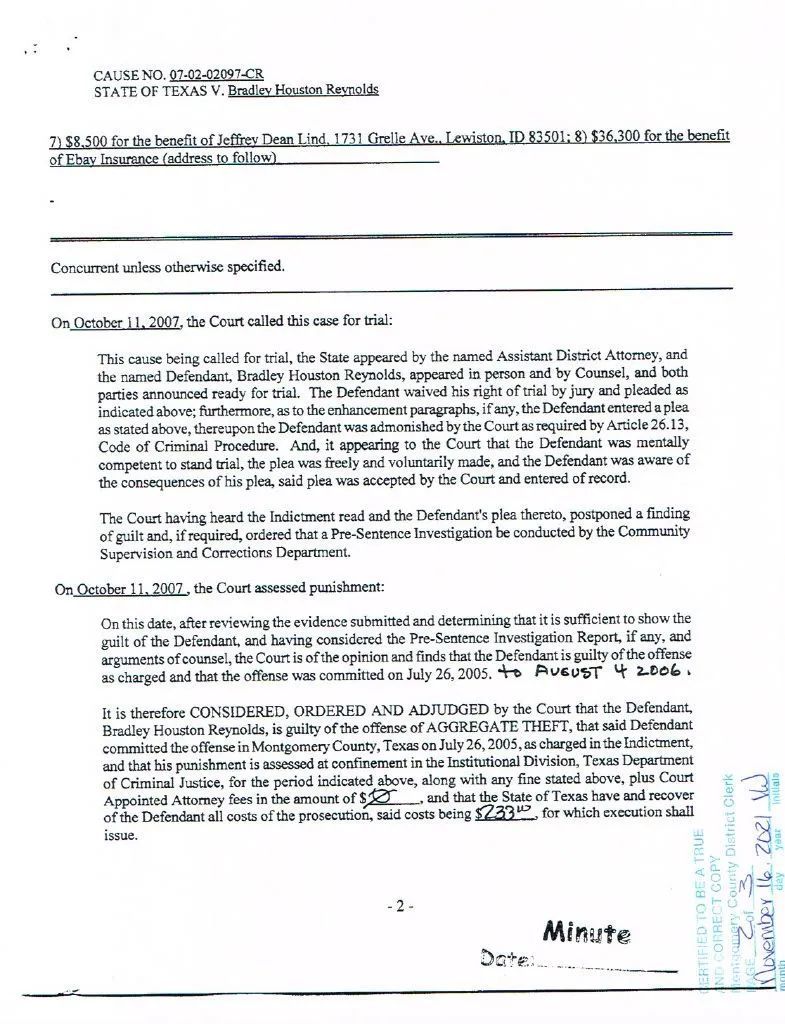

UNPAID RESTITUTION OWED SINCE 2007 TO 8 VICTIMS

The Superior Court has explained that nonpayment of fines or restitution is a

technical violation of probation only if the defendant can pay and has

willfully refused to pay.

Report to Collections

Call Collections

@

877-249-8297--023#

NO

https://youtu.be/PDPn-EqbknE?si=kE3XWdhKUKe7Obr8

https://www.justice.gov/atr/antitrust-laws-and-you

100 PERCENT ILLEGAL

TIED SELLING

FILE YOUR FTC CLAIM, REPORT THE FRAUD

Tying the sale to forced aftermarket products

https://www.youtube.com/embed/iH-UuZzSkOA

PUBLIC

NOTICE

WARNING

EX-CON

BRADLEY HOUSTON

REYNOLDS

Man arrested for defrauding on eBay

Still owes 8 Victims Restitution

$142,450.10 AS OF 12/29/2025

NOW

NEW ASSESSMENTS HAVE BEEN ARE ADDED

TO PREVIOUS BALANCE

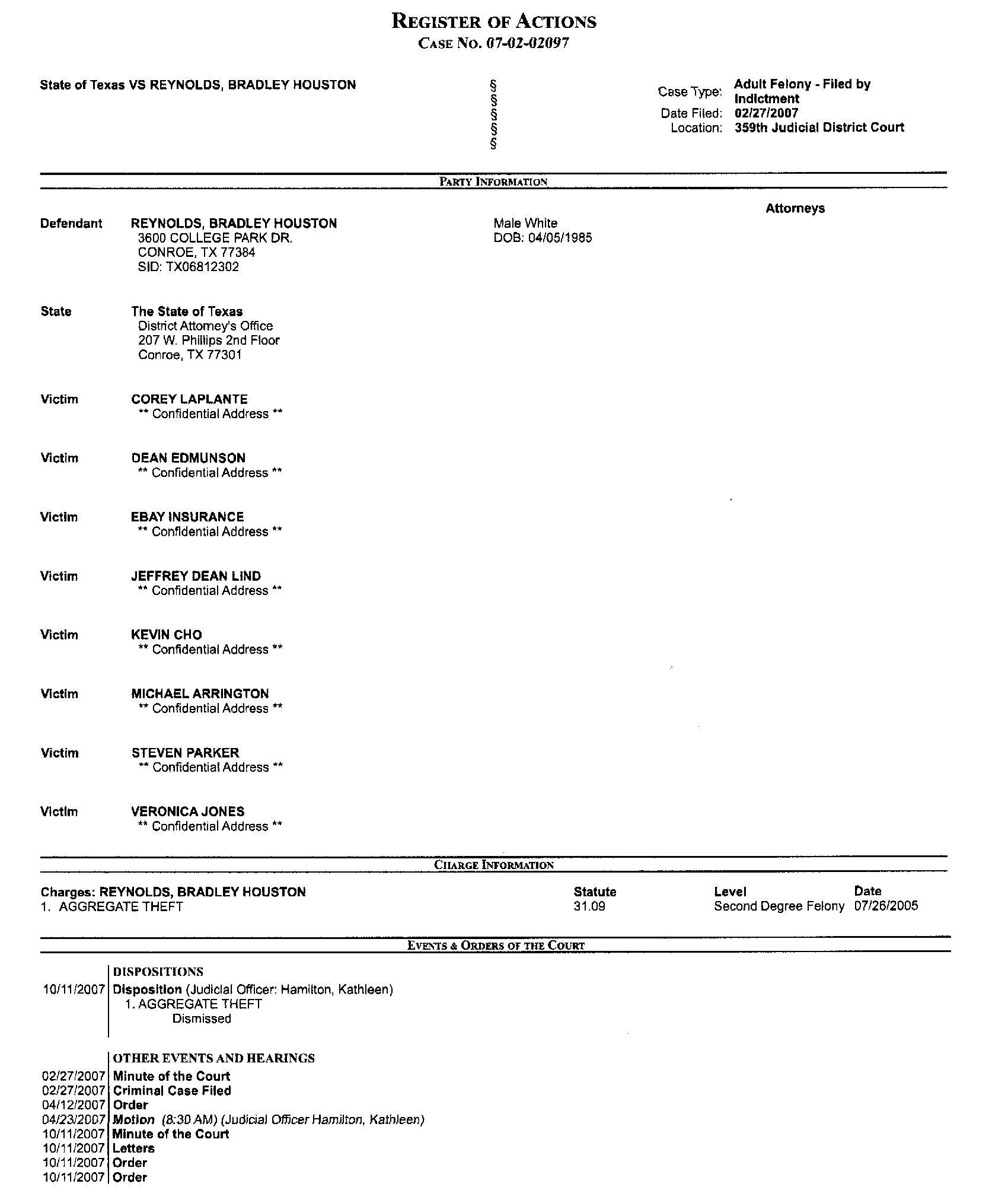

Montgomery County

REGISTER OF ACTIONS

CASE # 07-02-02097

New Balance OWED

WITH

30% INTEREST

ADDED!

NEW BALANCE IS

$ 142,450.10

NEW ASSESSMENTS ADDED

ON BELOW DATES

04/05/2024 $ 32,873.10

06/25/2024 $ 1,272.10

Call Collections

@

877-249-8297--023#

New victims of Automotive fraud

Report and call

Victoria County Sheriff's Office

101 N Glass St · (361) 575-0651

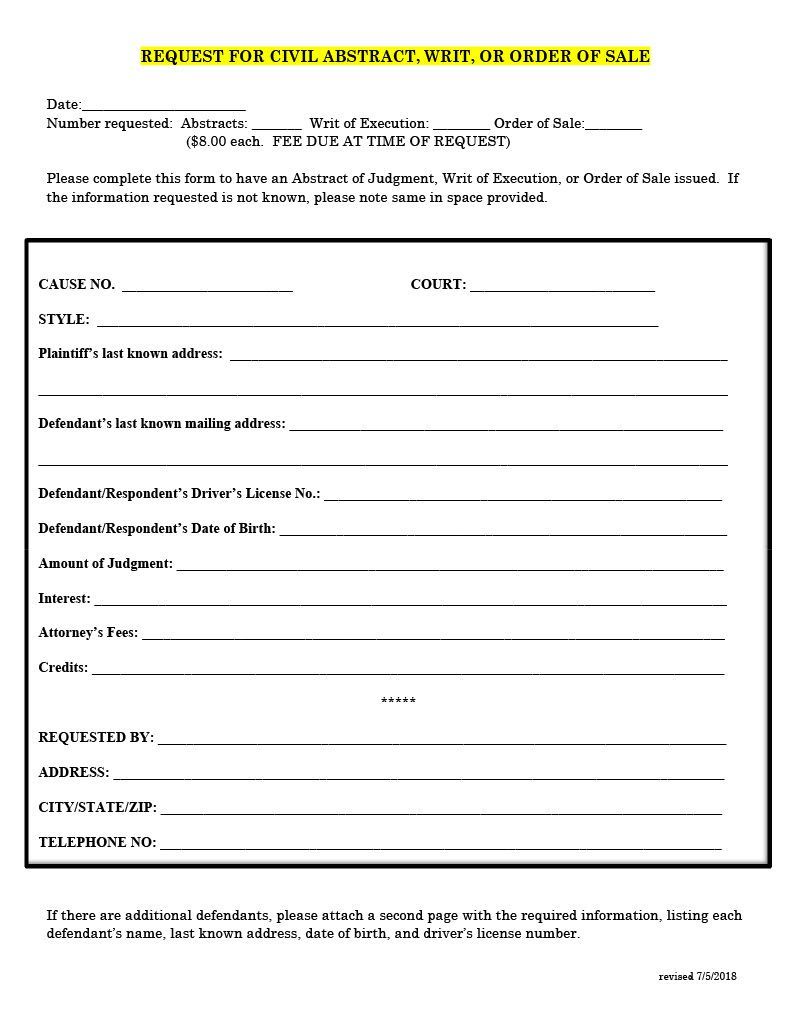

The victims may seek a:

Restitution Lien, Crime Victims’

Compensation Program,

Civil Lawsuit

"Office of House Bill Analysis S.B. 1778"

"https://lrl.texas.gov/scanned/officeOfHouseBAs/77-0/SB1778ENG.htm"

Probation from 2002-2005

INCLUDING

445 DAYS Incarcerated,

Incarcerated from 2006-July 2013

Reference 63 pages of Indictments

Below

"Whether you are released on community supervision after a prison sentence or serving probation, payment of court-ordered restitution may be a condition of your sentence. If you don’t pay the restitution, the Court may have several options including revoking your supervised release or probation, holding you in contempt of court, or converting your restitution amount to a civil judgment against you."

Moved from Montgomery Texas to Victoria Texas

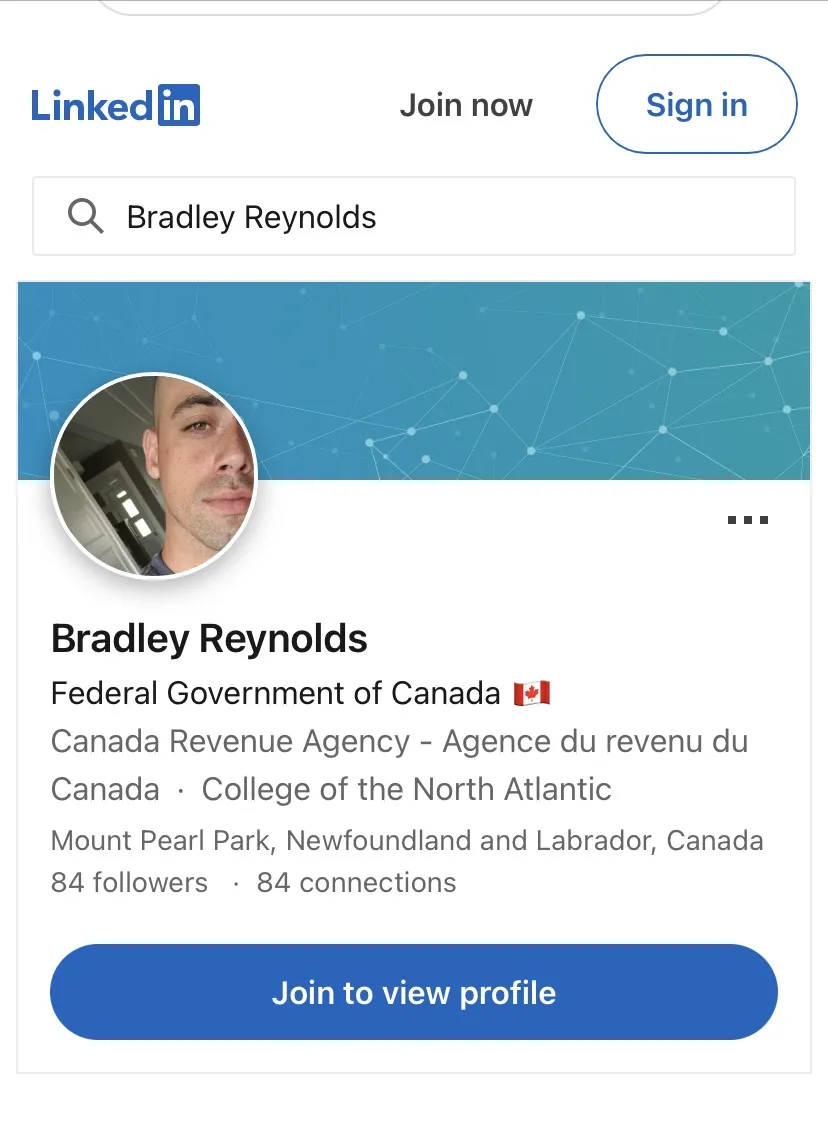

ABOVE PICTURE IS

EX-CON

AGGREGATE THEFT

Commits 100 % Fraud in Finance Department at Victoria Dodge Chrysler Jeep Ram Wagoneer In

Victoria, Texas as Finance Manager/Director owned by

Ben Keating Auto Group

361-333-5089

Violations of Dealership Compliance with consumer protections statutes, rules, and regulations, Dealer banking and Financial agreements

NO College Degree ! Latest Con!

Now Claiming Has Collège Degree

https://www.lonestar.edu/E-Verify-Info.htm

Human resources

"A conviction for Fraudulent, Substandard, or Fictitious Degree in Texas is punished as a Class B misdemeanor, with a maximum possible fine under Texas state law of up to $2,000 and jail time of up to 180 days."

Feb 1, 2024

BRAD REYNOLDS

(AKA)

BRAD REYNOLDS, BRAD H REYNOLDS, BRAD HOUSTON REYNOLDS, BRADLEY REYNOLDS, BRADLEY H REYNOLDS,

BRADLEY HOUSTON REYNOLDS, TIDERIDER51,

Brad Reynolds @tiderider51

srmartin01@gmail.com

evolution_gst@yahoo.com

the_next_evo@yahoo.com

fubreynolds61@ix.netcom.com

Brad Reynolds (@tiderider51) / X

https://www.linkedin.com/pub/dir/Bradford/Reynolds,

https://bo.linkedin.com/pub/dir/Brad/Reynolds

https://www.smartbackgroundchecks.com/people/brad-reynolds/El04ZwZ3ZQxjBQLkZmpjBGL2AGVm

https://www.linkedin.com/in/brad-reynolds-225676217/

https://www.chron.com/neighborhood/article/Man-arrested-for-defrauding-on-eBay-9599564.php

(512) 392-2425, (832) 326-9018, (903) 389-2233, (903) 493-4242, (936) 899-0419

To combat dealership fraud, consumers should be vigilant about checking details, thoroughly reviewing contracts, and reporting any suspected fraudulent activity to the dealership first, then to relevant state agencies like the consumer protection division of the Attorney General's office, the Federal Trade Commission (FTC), and the Better Business Bureau (BBB) if the issue isn't resolved; further action can include contacting a lawyer if necessary.

Current

Internet Information

YEARS:

2022, 2023, 2024, 2025

Fair Use, Educational, Formidable Continued Public Automotive Dealership Finance Fraud

WHISTLEBLOWERS

CONSUMER PUBLIC

WARNING!

Nonprofit Educational Purposes

"See Campbell v. Acuff-Rose Music, 510 U.S. 569, 578 (1994). Purposes such as these are often considered "in the public interest" and are favored by the courts over uses that merely seek to profit from another’s work—OnlinePolicy Group v. Diebold, Inc., 337 F. Supp. 2d 1195, 1203 (N.D. Cal. 2004)."

"The primary purpose of the FTC's CARS Rule is to add truth and transparency to the car buying or leasing process by making it clear that certain deceptive or unfair practices are illegal – for example, bait-and-switch tactics, hidden charges, and other conduct that harms consumers and honest dealers".

"What are the Penalties of Non-Compliance? Failure to comply with the FTC Safeguards Rule can result in significant fines and damage to your business's reputation. The updated guidelines that go into effect June, 2023 dictate the FTC can impose penalties of up to $100,000 per violation. Mar 29, 2023."

November 22, 2023

" The Federal Trade Commission (FTC) recently adopted a final rule amending its Standards for Safeguarding Customer Information (commonly referred to as the “Safeguards Rule”) to require financial institutions to report certain data breaches and other security events to the FTC.

These amendments come shortly after the Securities and Exchange Commission (SEC) adopted rules on mandatory cybersecurity disclosures as discussed in a prior LawFlash, demonstrating a focus by the US government on transparency regarding data breaches and other cybersecurity events. The FTC amendments become effective on May 13, 2024.

https://www.federalregister.gov/d/2024-03559/p-3

"On January 4, 2024, the Federal Trade Commission (“FTC” or “Commission”) published a Final Rule in the Federal Register , titled “Combating Auto Retail Scams Trade Regulation Rule” (“CARS Rule,” “Rule,” or “Final Rule”), in order to curtail certain unfair or deceptive acts or practices by motor vehicle dealers. The CARS Rule was to become effective on July 30, 2024. Because of a pending legal challenge, this document announces that the effective date of the Final Rule is delayed until further notice".

DATES:

"The effective date of the final rule adding 16 CFR part 463, published at 89 FR 590, January 4, 2024, is delayed indefinitely. The FTC will publish a subsequent notification in the Federal Register announcing the CARS Rule's effective date.

FOR FURTHER INFORMATION CONTACT":

"Daniel Dwyer or Sanya Shahrasbi, Division of Financial Practices, Bureau of Consumer Protection, Federal Trade Commission, 202-326-2957 (Dwyer), 202-326-2709 (Shahrasbi), ddwyer@ftc.gov, sshahrasbi@ftc.gov".

"The FTC announced the new rule in December 2023, aimed at reducing deceptive practices in the automotive industry, specifically bait-and-switch advertising and the imposition of hidden junk fees. Originally set to take effect July 30 of this year, it has been pushed back to Sept. 30, 2025".

"In January, the National Automobile Dealers Association (NADA) and the Texas Automobile Dealers Association (TADA) filed a legal challenge to the rule in the U.S. Court of Appeals for the 5th Circuit, moving to stay the rule’s July 30 effective date. In response to the stay motion, the FTC issued an order delaying the effective date of the rule pending judicial review of the NADA/TADA petition".

"However, despite the FTC’s postponement, the rule remains the law, necessitating the advancement of the amendment in the Fiscal Year 2025 Financial Services and General Government (FSGG) appropriations bill passed by the U.S. House Appropriations Committee".

"The Federal Trade Commission's (FTC) Combating Auto Retail Scams (CARS) Rule is being challenged by the National Automobile Dealers Association (NADA) and the Texas Automobile Dealers Association (TADA) in the U.S. Court of Appeals Fifth Circuit. The case was argued on October 9, 2024, and the outcome could have a significant impact on the automotive retail industry and independent dealerships.

REFERENCE Links Below"

https://www.txiada.org/blog_home.asp?Display=561

"The Federal Trade Commission proposed a new rule to stop marketers from using illicit review and endorsement practices such as using fake reviews, suppressing honest negative reviews, and paying for positive reviews, which deceive consumers looking for real feedback on a product or service and undercut honest business . "

Trade Regulation Rule on the Use of Consumer Reviews and Testimonials

"A Proposed Rule by the Federal Trade Commission on 07/31/2023"

Google, Dealership

and

Bradley Houston Reynolds

Bradley H Reynolds

(AKA) Brad Reynolds,

Continues to remove pictures,

Picture links, and alter web pages

by adding internal codes,

1920w and 640w for

blocking fair Use public pictures,

Reviews,

Documents,

AND

Claimed

Dealerships

Trade Secrets

of WHAT!

(FRAUD)

That violates the :

CRFA, FTC CAR Rules, TIDE RULES

For Public Warning Notice

For posting honest reviews,

Freedom of speech

And

Freedom of press

"Freedom of speech is a constitutional protection that gives individuals and communities the right to present their ideas and opinions without fear of being censored by the government. In the United States, the right to free speech, press, and assembly are guaranteed by the First Amendment of the Constitution. The exchange of ideas between people from different backgrounds is a key component to keeping a democracy healthy. While the government can censor some speech, American citizens are given the right to present their views publicly. This protection is important because it allows people to offer solutions to problems that represent their unique perspective. It is also another way of participating in society besides voting".

"RESTORING

FREEDOM OF

SPEECH

AND

ENDING

FEDERAL

CENSORSHIP"

EXECUTIVE ORDER

January 20, 2025

"By the authority vested in me as President by the Constitution and the laws of the United States of America, and section 301 of title 3, United States Code, it is hereby ordered as follows:

Section 1. Purpose. The First Amendment to the United States Constitution, an amendment essential to the success of our Republic, enshrines the right of the American people to speak freely in the public square without Government interference. Over the last 4 years, the previous administration trampled free speech rights by censoring Americans’ speech on online platforms, often by exerting substantial coercive pressure on third parties, such as social media companies, to moderate, deplatform, or otherwise suppress speech that the Federal Government did not approve. Under the guise of combatting “misinformation,” “disinformation,” and “malinformation,” the Federal Government infringed on the constitutionally protected speech rights of American citizens across the United States in a manner that advanced the Government’s preferred narrative about significant matters of public debate. Government censorship of speech is intolerable in a free society.

Sec. 2. Policy. It is the policy of the United States to: (a) secure the right of the American people to engage in constitutionally protected speech;

(b) ensure that no Federal Government officer, employee, or agent engages in or facilitates any conduct that would unconstitutionally abridge the free speech of any American citizen;

(c) ensure that no taxpayer resources are used to engage in or facilitate any conduct that would unconstitutionally abridge the free speech of any American citizen; and

(d) identify and take appropriate action to correct past misconduct by the Federal Government related to censorship of protected speech.

Sec. 3. Ending Censorship of Protected Speech. (a) No Federal department, agency, entity, officer, employee, or agent may act or use any Federal resources in a manner contrary to section 2 of this order.

(b) The Attorney General, in consultation with the heads of executive departments and agencies, shall investigate the activities of the Federal Government over the last 4 years that are inconsistent with the purposes and policies of this order and prepare a report to be submitted to the President, through the Deputy Chief of Staff for Policy, with recommendations for appropriate remedial actions to be taken based on the findings of the report.

Sec. 4. General Provisions. (a) Nothing in this order shall be construed to impair or otherwise affect:

(i) the authority granted by law to an executive department or agency, or the head thereof; or

(ii) the functions of the Director of the Office of Management and Budget relating to budgetary, administrative, or legislative proposals.

(b) This order shall be implemented consistent with applicable law and subject to the availability of appropriations.

(c) This order is not intended to, and does not, create any right or benefit, substantive or procedural, enforceable at law or in equity by any party against the United States, its departments, agencies, or entities, its officers, employees, or agents, or any other person.

THE WHITE HOUSE,

January 20, 2025."

"Freedom of press is a right related to freedom of speech that protects journalists, news outlets, and other ways of publicly disseminating information. Freedom of speech is a broad right that encompasses almost every aspect of communication, whereas freedom of press specifically grants the right to freely express ideas and opinions through the internet, newspapers, television, radio, and any other means of public communication. Freedom of press is an immensely important right. Societies that censor the press are oftentimes far less democratic than those that allow the press to speak freely. The lack of free press was a key issue for the Founding Fathers, as British censorship was exceedingly severe. This became a major problem because the political issues that faced the American colonists could not even be discussed in print. Press members who are allowed to criticize or praise the government and other powerful entities without fear of reprisal, leads to a more transparent society where the interests of the people can be represented".

"The First Amendment protects Google's right to select and present information as a speaker. This means that the government can't hold Google liable for biases that may prevent readers from getting a balanced presentation. The First Amendment also protects online platforms, which the Supreme Court has said should receive the same level of protection as print media. This includes the ability to exercise First Amendment rights while also creating a space for users to express themselves freely".

"The Consumer Review Fairness Act makes it illegal for companies to include standardized provisions that threaten or penalize people for posting honest reviews" .

What’s the penalty for violating the Consumer Review Fairness Act?

" Congress gave enforcement authority to the Federal Trade Commission and the state Attorneys General. The law specifies that a violation of the CRFA will be treated the same as violating an FTC rule defining an unfair or deceptive act or practice. This means that your company could be subject to financial penalties, as well as a federal court order.

To make sure your company is complying with the Consumer Review Fairness Act:

- Review your form contracts, including online terms and conditions; and

- Remove any provision that restricts people from sharing their honest reviews, penalizes those who do, or claims copyright over peoples’ reviews (even if you’ve never tried to enforce it or have no intention of enforcing it).

The wisest policy: Let people speak honestly about your products and their experience with your company " .

EX-CON

BRAD REYNOLDS

(AKA)

BRAD REYNOLDS, BRAD H REYNOLDS, BRAD HOUSTON REYNOLDS, BRADLEY REYNOLDS, BRADLEY H REYNOLDS,

BRADLEY HOUSTON REYNOLDS, TIDERIDER51,

Brad Reynolds @tiderider51

Brad Reynolds (@tiderider51) / X

Committing 100 % Fraud in the finance department at Victoria Dodge Chrysler Jeep Ram Wagoneer In

Victoria, Texas, as Finance Manager /Director

WARNING

Have you been victimized by:

Bradley Houston Reynolds?

(AKA) Brad Reynolds, Brad H Reynolds, Brad Houston Reynolds, located in

Victoria, Texas

Continuous FRAUD;

100% AUTOMOTIVE FINANCIAL FRAUD,

100% Illegal packing Products,

Includes:

The non-disclosure and forcing or requiring aftermarket products, by

Claiming Bank or Lender / Dealership requires Aftermarket products to purchase the vehicle

100% Illegal Straw forced purchases

100% Illegal claiming Fake fees are government required fees but are Optional Dealership undisclosed Aftermarket Products

100% Illegal claiming Fake fees are required to purchase Automobile

100% illegal for not providing all true

and accurate paperwork to buyer before leaving the dealership

100% illegal to use stamped signature of customers name for Aftermarket Product, Fake Fees or Automotive Contracts

Bradley Houston Reynolds

100% FALSIFIED COLLEGE EDUCATION

100% NO College or College DEGREE

Lone Star College

"A conviction for Fraudulent, Substandard, or Fictitious Degree in Texas is punished as a Class B misdemeanor, with a maximum possible fine under Texas state law of up to $2,000 and jail time of up to 180 days."

Feb 1, 2024

100% FALSIFIED SALESMANAGER POSITION LISTINGS

PREVIOUS JOBS WERE SALES-RELATED

and

Only 1

"Mangers Position"

A

" INTERNET MANAGER"

Brad Reynolds

THEN CLAIM 1/2 DEAL

CREDITS AND RDR'S FROM OTHER

SALESPERSONS IN THE INTERNET DEPARTMENT

TO GET GST SALESPERSONS AWARDS

AWARDS ARE FOR THE SALES PERSONS

AND

NOT THE INTERNET MANAGER / SALESPERSON!

100% Fraud GST FRAUD

NO MILITARY BACKGROUND AS CLAIMED

NO COLLEGE DEGREE

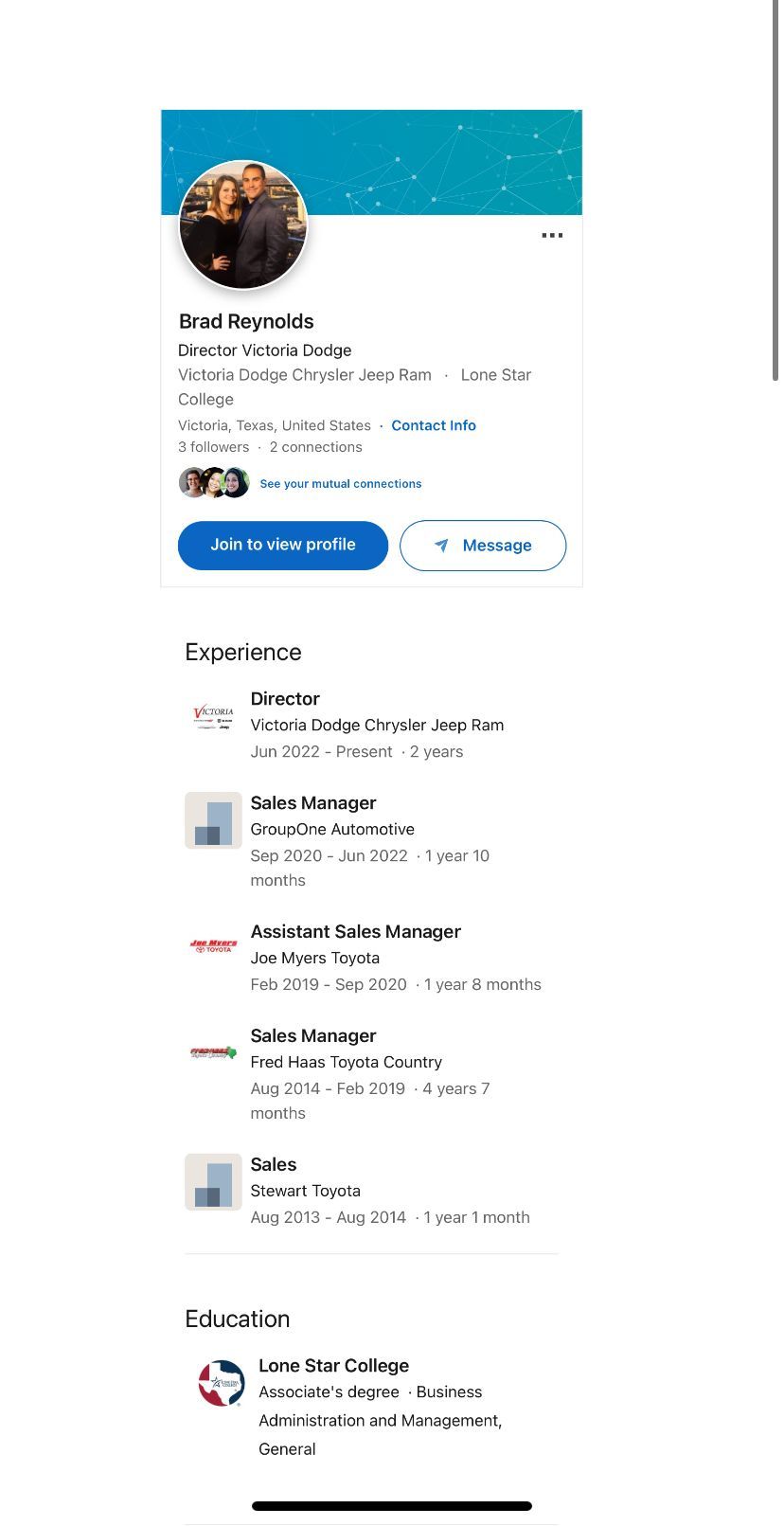

FRAUD LISTING ON LINKEDIN

https://www.linkedin.com/in/brad-reynolds-225676217

"A conviction for Fraudulent, Substandard, or Fictitious Degree in Texas is punished as a Class B misdemeanor, with a maximum possible fine under Texas state law of up to $2,000 and jail time of up to 180 days."

Feb 1, 2024

https://www.linkedin.com/pub/dir/Brad/Reynolds

Probation Time: 2002 - 2005

Incarcerated Time: 2006 - July 2013

REPORT & FILE:

With FTC, FBI, IRS, SSI, VICTORIA POLICE, MONTGOMERY POLICE,

VICTORIA ADVOCATE LOCAL NEWS, FINANCIAL FINANCING LENDER BANKS

https://reportfraud.ftc.gov/#/assistant

Victoria, Texas

12/29/2025

ALL LOCAL & FEDERAL

ENFORCEMENT

REPEATEDLY INFORMED

The Consumer Review Fairness Act makes it illegal for companies to include standardized provisions that threaten or penalize people for posting honest reviews.

PUBLIC WARNING

NOTICE!

Keating Auto Group

Hired an

Automotive Ex-Con, Brad Reynolds,

Sales Person

for a Finance/Director

Manager Position

Deals

Directly with

Financial Institutions

knowing his exposure to

customers private information

& He chooses

which banks/lender to use in

Finance

Department and structures

Automotive finance loans with the

lender banks

at

Victoria Dodge Jeep Ram Wagoneer

Dealership Victoria, Texas on

consumers' behalf.

Dealership Financial Bank

Agreements

are

Questionable!

" Dealership agreement is a legal contract that outlines the rights and responsibilities of an automobile manufacturer and an automobile dealer. A dealer agreement can also govern the business relationship between a general dealer and a vendor".

Bradley Houston Reynolds

Committing 100% Fraud

at

Dealership!

ALL victims report to:

&

VICTORIA POLICE

FINANCED

PURCHASERS

REQUEST ALL

LOAN PAPERS

FROM YOUR

FINANCING BANK

LENDER

TO BE MAILED

TO YOU

THEN COMPARE ALL

PAPERWORK FROM

YOUR BANK

TO YOUR PAPERWORK

RECEIVED FROM YOUR

DEALERSHIP AT TIME

OF

PURCHASE

CHECK FOR

REAL SIGNATURES

NOT

STAMPED SIGNATURES

NOT

DISCLOSED OR FORCED

AFTERMARKET

PRODUCTS ADDED

REQUEST

CANCELLATION

PAPERWORK FROM

DEALERSHIP!

SIGN ALL

CANCELLATION

FORMS YOU CHOOSE

WITH DEALERSHIP

TAKE PICTURES OF ALL

DOCUMENTS

REPORT TO YOUR

FINANCING LENDER

WEEKLEY AND INFORM

THAT

YOU SIGNED

CANCELLATIONS

FORMS

INCLUDING

FRAUD FINDINGS

FORGED

SIGNATURES,

STAMP SIGNATURES

FOR NON-DISCLOSED

AFTERMARKET

PRODUCTS

THEN

AFTER FILING

CANCELLATIONS

VERIFY 1 MONTH

LATER WITH THE

FINANCING

BANK

AND

DEALERSHIP

FOR CANCELLATIONS

CREDITS REMOVED

FROM

LOAN AMOUNT /

FINANCED

BALLANCE DUE

YOUR PAYMENT WILL

STAY THE SAME BUT

YOUR LOAN BALANCE

OWED WILL BE

LOWERED AND WILL

PAY OFF SOONER

"On October 9, 2024, the Fifth Circuit heard oral argument on the administrative challenge lodged by the National Automobile Dealers Association (NADA), a national trade association representing the interests of U.S. car dealers, against the Combating Auto Retail Scams (“CARS”) Trade Regulation Rule issued by the ..."

https://www.jdsupra.com/legalnews/nada-faces-skeptical-fifth-circuit-3722473/

" The FTC Safeguards Rule is a set of updated regulations announced by the Federal Trade Commission in late 2021 that requires financial institutions to develop and implement a comprehensive information security program. The Safeguards Rule is an integral part of the FTC’s efforts to protect the security, confidentiality, and integrity of customer-sensitive information from cyberattacks, identity theft, and other forms of fraud. Beginning June 9, 2023, the FTC Safeguards Rule will officially take effect, and all financial institutions, including “non-banking financial institutions” like auto dealerships, will be required to prove their compliance.

The rule applies to all businesses that collect or maintain sensitive customer information, including large institutions like banks, credit card companies, and small businesses. The FTC has enforcement authority over the safeguards rule and can punish companies failing to comply with the rule requirements ".

Reference Video Below:

How a Finance Manager, Director, Sales managers, Managers can use your private information illegally when acquiring your financing with dealership lenders

Watch Video Below:

"Old Example"

OF

AUTOMOTIVE FINANCE FRAUD

Victoria Dodge Chrysler Jeep Ram Wagoneer, Victoria Texas, 77904

361-333-5089

Employed Ex-Con

BRAD REYNOLDS, BRAD H REYNOLDS, BRAD HOUSTON REYNOLDS, BRADLEY REYNOLDS, BRADLEY H REYNOLDS,

BRADLEY HOUSTON REYNOLDS, TIDERIDER51, Brad Reynolds @tiderider51

https://twitter.com/tiderider51?lang=en

New Examples

Commits 100 % Fraud in Finance Department at Victoria Dodge Chrysler Jeep Ram Wagoneer In

Victoria, Texas as Finance Manager

EX-CON BRAD REYNOLDS HAS

CREATED FRAUDULENT FEES WORKSHEET

TO CLAIM FRAUD FEES AS "REQUIRED GOVERNMENT FEES"

"Taxable or Non Taxable"

LISTED BELOW ARE

100% ILLEGAL

FRAUD & DECEPTION

Also

PACKING

UNWANTED

NON-DISCLOSED

FORCED OR CLAIMED

REQUIRED AFTERMARKET

OPTIONAL PRODUCTS

PUBLIC NOTICE!

REQUEST YOUR COPIES OF THE LOAN PAPERWORK FROM YOUR

FINANCE BANK / LENDER

&

COMPARE TO YOUR DEALERSHIP PAPERWORK AND USB DRIVE FOR ALTERATIONS AND FORGERY

INCLUDING:

PACKING AFTERMARKET PRODUCTS, CHANGING INTEREST RATE, FORGING SIGNATURES, STAMPED SIGNATURES, REMOVING OR ALTERING CASH DOWN PAYMENT, OR INFLATING SALES PRICE TO CREATE FALSE DOWN PAYMENT, CASH CUSTOMER REBATES NOT SHOWNED AS DOWN PAYMENT.

ANY DISCREPANCIES

FILE REPORT NOW

WITH

FTC, FBI, VICTORIA POLICE,

LINK BELOW

& Victoria Police Investigations

CALL 361-485-3730

https://www.ftc.gov/news-events/news/press-releases/2023/10/ftc-proposes-rule-ban-junk-fees

" BRAD REYNOLDS "

FINANCE MANAGER / DIRECTOR

100% ILLEGAL FEES

&

DECEPTION

FRAUD

VICTORIA DODGE CHRYSLER JEEP RAM

DEALERSHIP GENERAL MANAGER

JAMES LAW / OWNER

THREATENS SLANDER TO CUSTOMERS

FOR STATING THE TRUTH

ABOUT FRAUD, DECEPTION, STRAW PURCHASES, & FEES, REQUIRING THE UNDISCLOSED ADD OF A GPS TRACKING SYSTEM IN ALL VEHICLES, AND IS NOT DISCLOSED ON A REQUIRED ADDENDUM STICKER, BAIT AND SWITCH,

AND CONTINUOUSLY REMOVES NEGATIVE REVIEWS FROM GOOGLE, YELP, FACEBOOK, AND TWITTER

WHICH PROVED TO BE

100% ILLEGAL

REPORT

https://reportfraud.ftc.gov/#/assistant

The Consumer Review Fairness Act makes it illegal for companies to include standardized provisions that threaten or penalize people for posting honest reviews.

DEALERSHIP MANAGERS

CREATED

2 DEALERHIP FORCED STRAW PURCHASES

MANDATE'S OPTIONAL AFTERMARKET PRODUCTS

FOR THE PURCHASE OF 1 USED VEHICLE THEN 1 NEW VEHICLE

VEHICLE WAS FOR BOYFRIEND ONLY, NOT GIRLFRIEND !

Both VEHICLE LOANS are in Girlfriends name only!

100% ILLEGAL

STRAW PURCHASES

GENERAL MANAGER

JAMES LAW/OWNER

THREATENS SLANDER TO CUSTOMERS

FOR STATING TRUTH ABOUT DEALERSHIP

FRAUD INCLUDING

FRAUD, DECEIT, PACKING PRODUCTS, STRAW

PURCHASES,

UNDISCLOSED

GPS TRACKING SYSTEM ADDED

ADD-ONS,

PRODUCTS UNDISCLOSED AND NOT ON VEHICLE

ADDENDUM STICKER,

& CLAIMED AS GOVERNMENT FEES IN THE

FINANCE DEPARTMENT

THAT ARE

100% ILLEGAL

"Tied selling, which is against the law, occurs when a company conditions the sale of a product or service only if that customer purchases some other product or service. In the U.S., "tied-in" selling or "tied" products are addressed by both the Federal Trade Commission (FTC) and the U.S. Department of Justice (DOJ)."

REPORT NOW

https://reportfraud.ftc.gov/#/assistant

Non-compliance can lead to fines of up to $100,000 per violation.

"Federal Trade Commission"

Revised FTC Safeguards Rule deadline was June 9, 2023

The updated rule requirements include Planning and action to address “reasonably foreseeable internal and external risks” – including data breaches, data leakage, and ransomware. Multi-factor authentication.

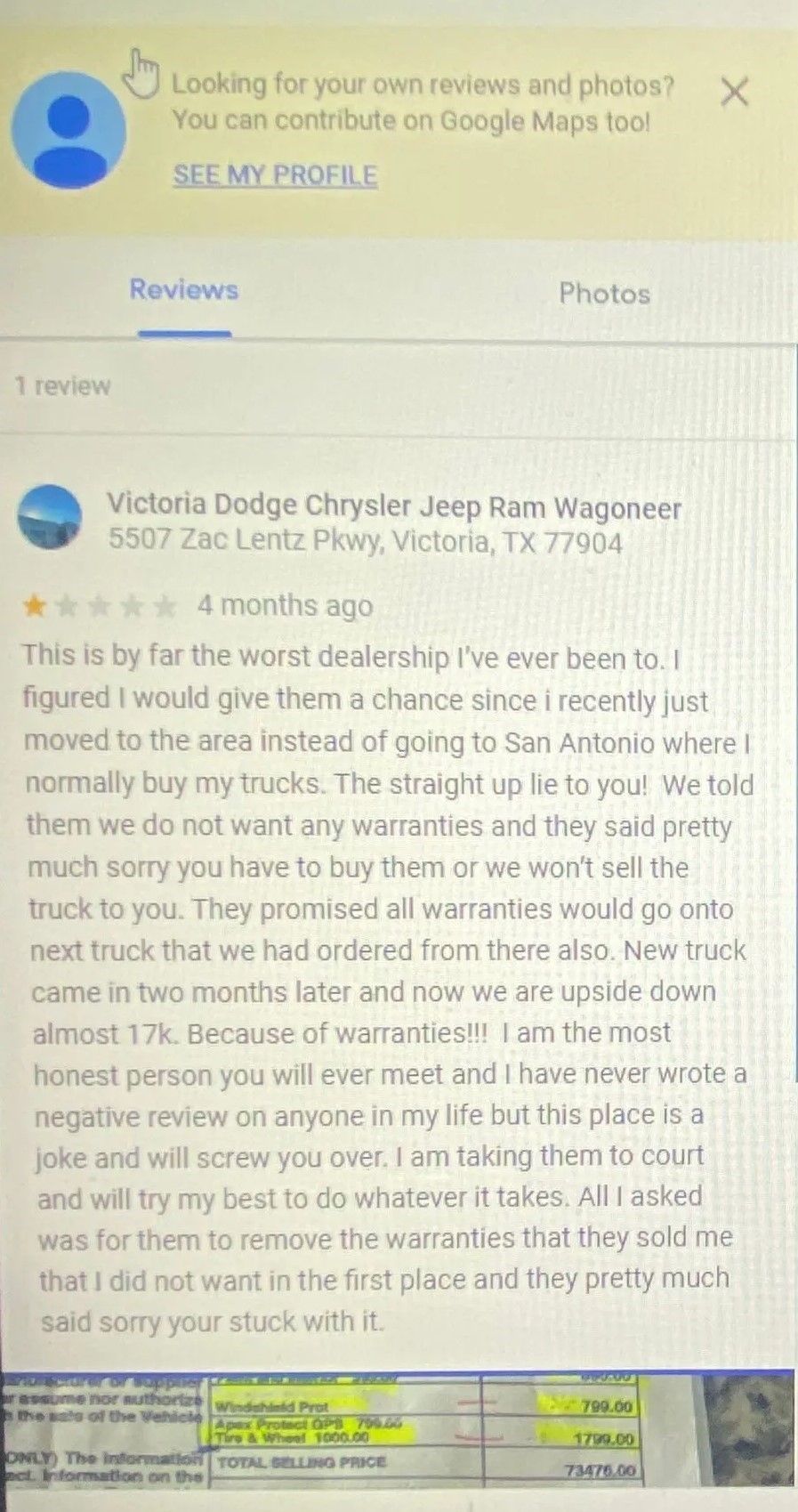

Dealerships ' complaints concerning

Fraud and Deception

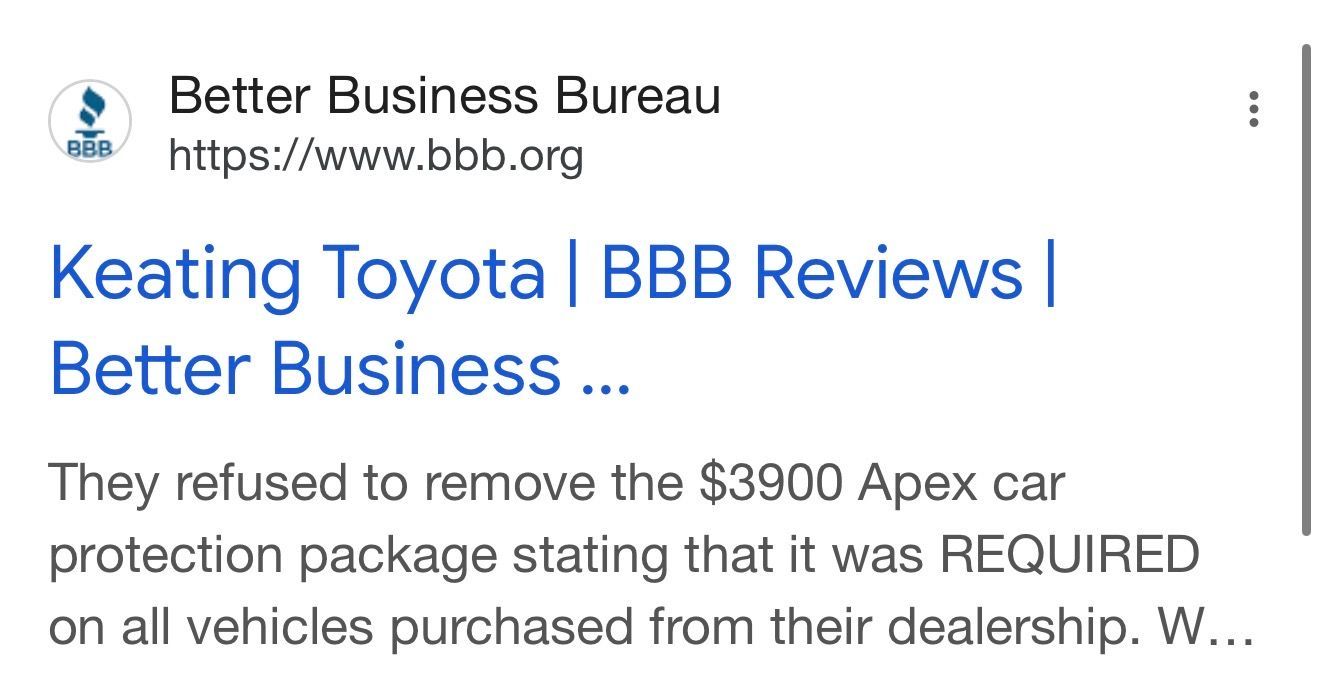

CURRENT ALERTS FOR THIS BUSINESS,

"Pattern of Complaints: KEATING DEALERSHIPS"

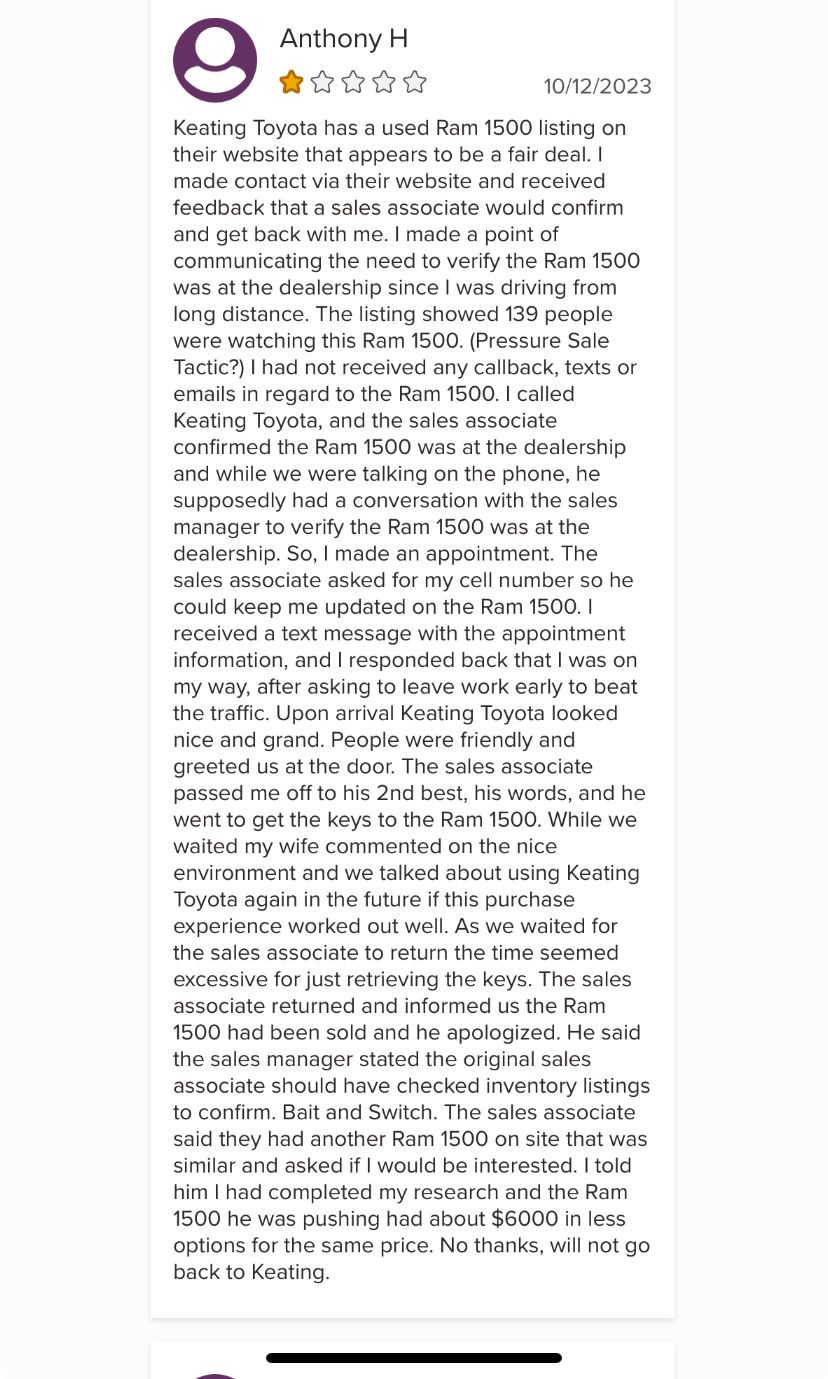

"Since January 2021, the BBB of Greater Houston & South Texas has received several complaints and customer reviews on Keating Dealerships, Toyota that exhibit the following pattern.

According to the consumer’s disputes, it is being alleged that Keating Toyota advertises a low price online but is higher once at the dealership. Consumers are reporting that the dealer add-ons are being added during the financing phase without prior knowledge. Some consumers are reporting that they are unsuccessful in reaching the finance department to cancel warranties".

https://www.bbb.org/file-a-complaint

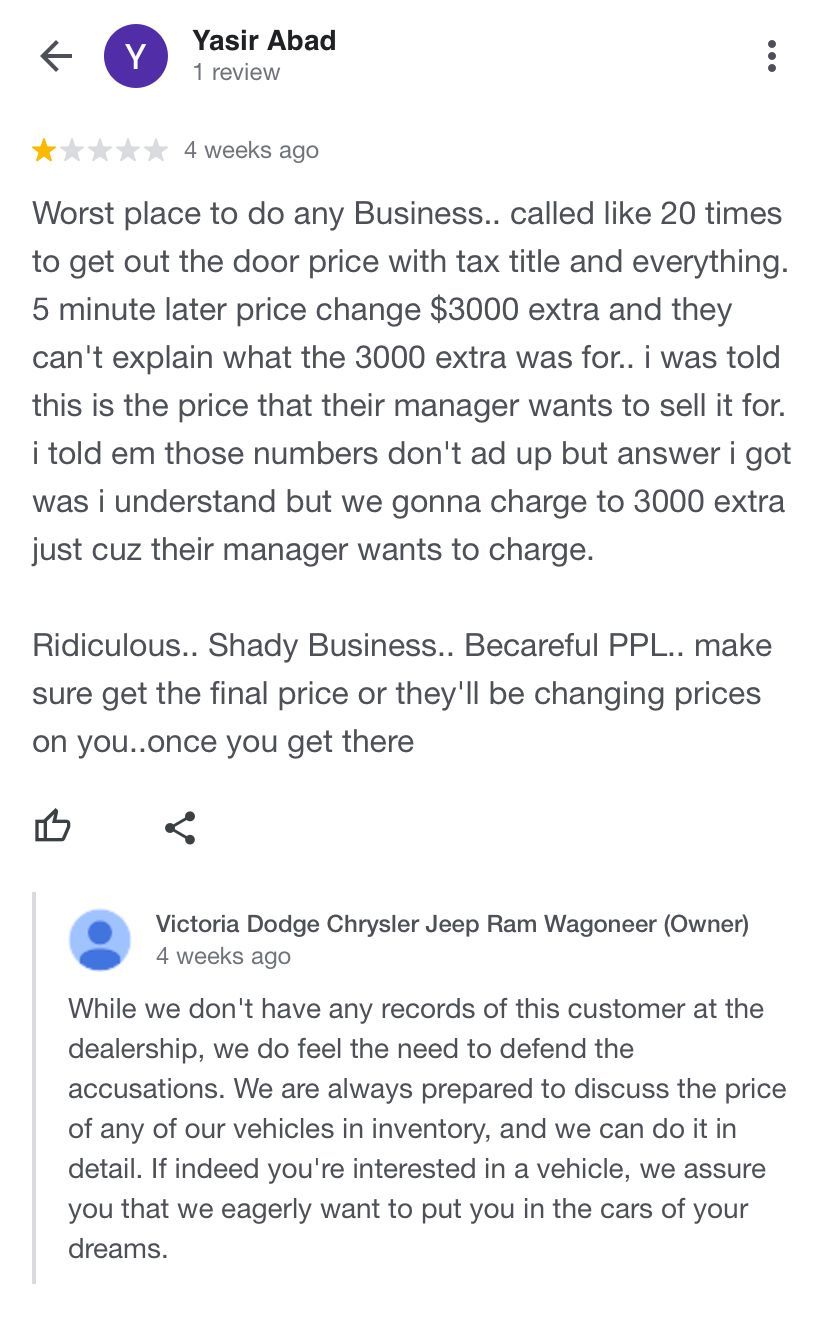

Dealership, Employees continues to remove bad reviews.

1 - https://texags.com/forums/46/topics/3272009

2 -

16 CFR Part 465: Trade Regulation Rule on the Use of Consumer Reviews and

3 - https://www.yelp.com/not_recommended_reviews/keating-toyota-manvel

4 -https://www.yelp.com/biz/keating-toyota-manvel?

hrid=aePimeG0gIWEJDaKkZUUsg&rh_type=phrase&rh_ident=alvin

5 - https://www.autotrader.com/car-dealers/victoria-tx-77901/71645635/victoria-dodge

6- https://www.dealerrater.com/dealer/Keating-Toyota-review-118490/

8 - https://www.cars.com/dealers/6000267/keating-toyota/

9 - https://www.bbb.org/us/tx/manvel/profile/new-car-dealers/keating-toyota-0915-90061054

10 -https://www.yelp.com/user_details?userid=g_DONMTzZt07s8K-ffMxZw

11 -https://www.yelp.com/biz/victoria-dodge-victoria

12- https://m.facebook.com › victoria100club › posts

"Federal Trade Commission Announces Proposed Rule Banning Fake Reviews and Testimonials"

" The FTC also announced that it was proposing a new Rule concerning the use of consumer reviews and testimonials based upon feedback received in response to the FTC’s November 2022 Advanced Notice of Proposed Rulemaking.[8] The proposed Rule would specifically prohibit: (1) selling or obtaining fake consumer reviews and testimonials; (2) review hijacking; (3) buying positive or negative reviews; (4) insider reviews and testimonials; (5) company-controlled review websites; (6) illegal review suppression or removal; and (7) selling fake social media indicators such as fake followers or views.[9] There will be sixty days for public comment once the Federal Register Notice appears in the Federal Register. "

---------------------------------------------------------------------------------------------------------

AN UNBELIEVABLE

CONTINUOUS COVER UP!

VICTORIA DODGE DEALERSHIP

Donated a vehicle to the police department.

FOR WHAT REASON?

PENAL CODE CHAPTER 36. BRIBERY AND CORRUPT INFLUENCE

"Great work Ben Keating! Thank you for your generosity ... Victoria Dodge Donates New Car to the Victoria Police Dept. to Help " Fight Crime" - Crossroads Today.?

link: https://m.facebook.com/victoria100club/posts/3118939045020081/

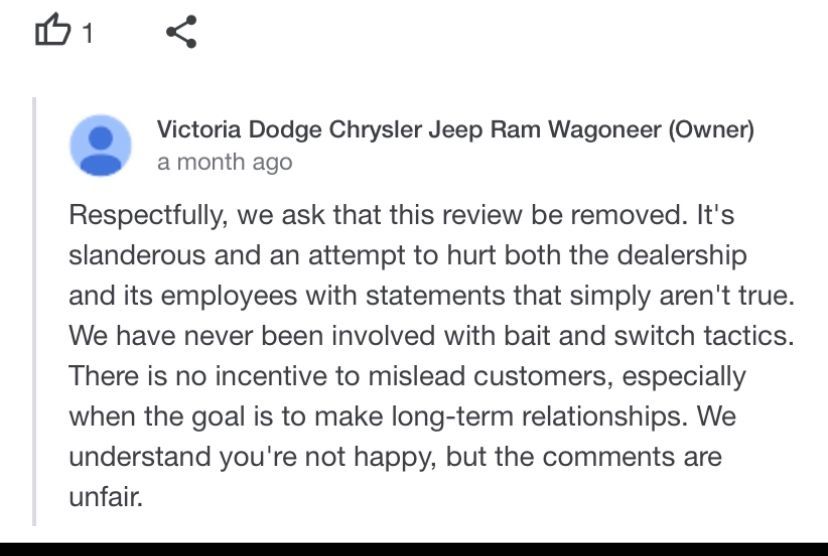

DEALERSHIP "CLAIMED OWNER"

REPLIES BELOW

GENERAL MANAGER

JAMES LAW / OWNER

DEALERSHIP GENERAL MANAGER / OWNER

JAMES LAW

CONTINUES TO

THREATENS SLANDER TO CUSTOMERS

FOR STATING THE TRUTH

ABOUT FRAUD, DECEIT, STRAW PURCHASES, & FAKE FEES, THE REQUIRING OF AFTERMARKET PRODUCTS AND REQUIRING A UNDISCLOSED ADD OF A GPS TRACKING SYSTEM IN ALL VEHICLES, NON DISCLOSURE OF PRODUCTS REQUIRED ON AN ADDENDUM STICKER ON WINDOW OF VEHICLE

AND IS CONTINUOUSLY REMOVING NEGATIVE REVIEWS FROM GOOGLE

WHICH PROVE TO BE

100% ILLEGAL!

REPORT

The Consumer Review Fairness Act makes it illegal for companies to include standardized provisions that threaten or penalize people for posting honest reviews.

https://www.capitalone.com/cars/dealership/Victoria-TX/Victoria+Dodge+Chrysler+Jeep+Ram/41859

Bearded RV Tech Aug 12, 2023

Rating:

1 stars out of 5 stars

★----

“One star is too high! Found the vehicle I wanted, called them to verify they had the jeep I wanted let them know it was 110 miles one way. Once I got there, I test drove the desired jeep, loved it. But... the price went from $38,818 to 43,500. What??? Oh well, there's the appearance package. " I don't want that!" It's already on there. I don't want it. Then there's window tent, "I don't want it!" The bottom line is they did NOT honor the price listed on Autotrader. Tried to tell me Autotrader is never right, odd thing the same price was listed on their website. Stay AWAY from them. Run don't walk!!!!!!!!!!!!!! Louder.”

Report Fraud, Waste or Abuse

https://www.txdmv.gov/complaints

(888) 368-4689

https://reportfraud.ftc.gov/#/assistant

https://oig.hhsc.state.tx.us/wafrep/

Fraud Hotline:

(800) 436-6184

The Narcissist as a "Criminal"

https://www.psychologytoday.com/us/blog/inside-the-criminal-mind/202002/the-narcissist-cri

GREED DECEPTION AND FRAUD

Victoria Dodge Chrysler Jeep Ram Wagoneer, Victoria Texas,

EMPLOYEE

BRAD REYNOLDS, BRAD H REYNOLDS, BRAD HOUSTON REYNOLDS, BRADLEY REYNOLDS, BRADLEY H REYNOLDS,

https://twitter.com/tiderider51

https://twitter.com/tiderider51?lang=en

Automotive aggregate

Felony Theft

WHO OWES RESTITUTION TO

8 VICTIMS

$ 142,450.10

is

CURRENTLY EMPLOYED IN

FINANCE DEPARTMENT

At

Victoria Dodge Chrysler Jeep Ram Wagoneer,

Victoria Texas

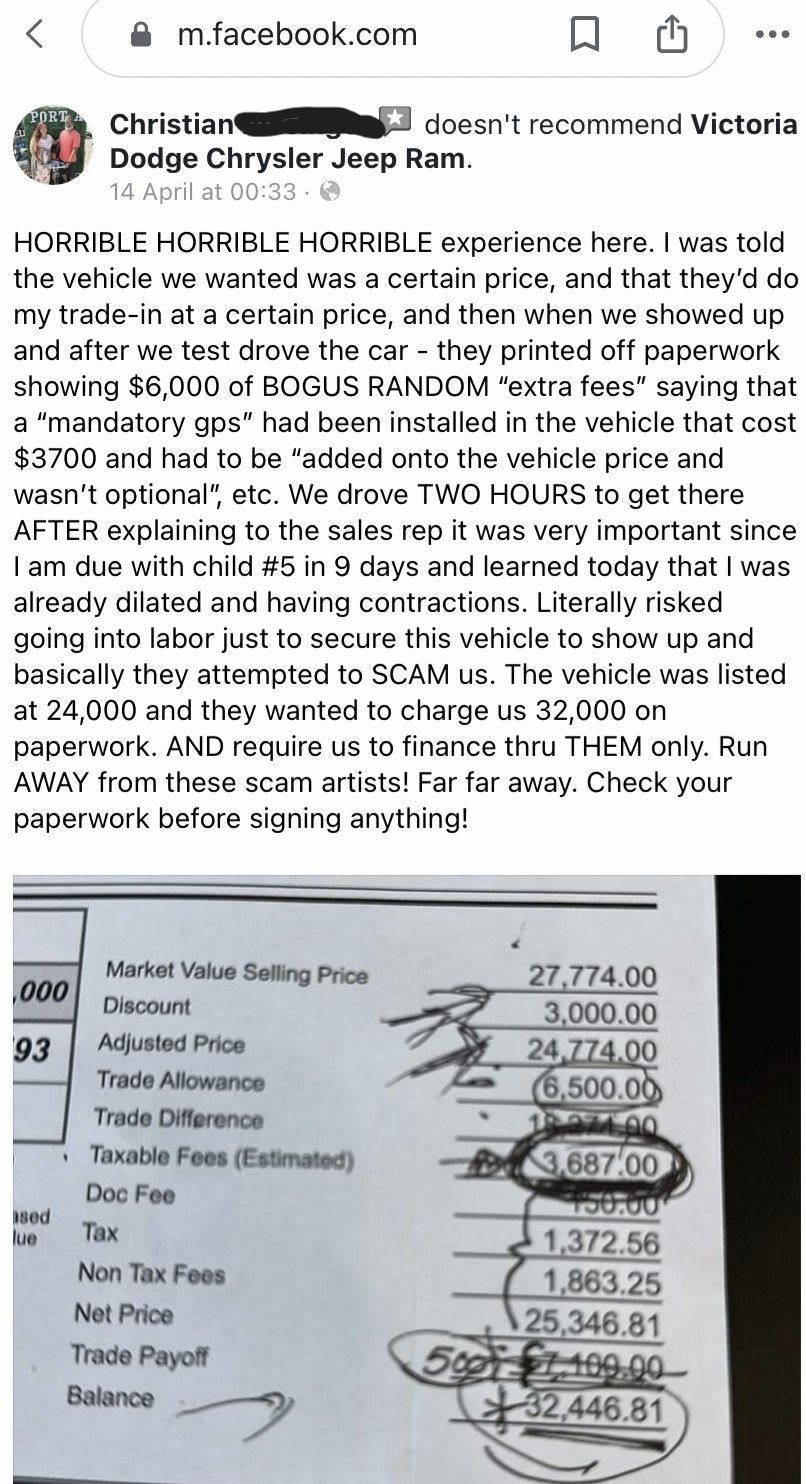

REQUIRING

BOGUS RANDOM EXTRA FEES

and

MANDATORY GPS TRACKING and CLAIMS PRODUCTS ARE

NOT OPTIONAL AND ARE GOVERNMENT FEES!

100% ILLEGAL

2022 2023 2024 2025

FILE AND REPORT ALL FRAUD

WITH FTC

Victoria Police Investigations

361-485-3730

Victoria US MARSHALS SERVICE

(361) 578-4932

18 U.S. Code § 1344

Bank Fraud

"Whoever knowingly executes, or attempts to execute, a scheme or artifice—

(1)to defraud a financial institution; or

(2)to obtain any of the moneys, funds, credits, assets, securities, or other property owned by, or under the custody or control of, a financial institution, by means of false or fraudulent pretenses, representations, or promises;"

2022, 2023, 2024, 2025

VICTIM

AUTOMOTIVE

WHISTLEBLOWERS

ALL of your confidential

information

is

exposed

to this EX-CON,

"BRAD REYHNOLDS"

"BRADLEY HOUSTON REYNOLDS"

Who still owes restitution of

$142,450.10

to 8 victims

12/29/2025

Including

Your Social Security Information, SSI Number, Complete full Name, Address, Credit Cards Information, Banking Information, loans, Balances, and Personal Information for current and future use.

Reference video below:

HOW A FINANCE MANAGER USED CUSTOMERS PRIVATE INFORMATION

DID THE DEALERSHIP,

Victoria Dodge Chrysler Jeep Ram Wagoneer, Victoria Texas,

WARN YOU OF HIS ACTIVITY!

Violation

"PRIVACY POLICY CONSIDERATIONS"

Reference video below :

How a finance manager can use your information

Old Example Below!

https://youtu.be/7doEIs4eGvwAbove video is an old Example when F&I Manager were able to see your credit.

Cause No 07-02-02097CR$142,450.10

NEW ASSEMENTS ADDED06/14/2024 $ 32,873.10 INTEREST&06/24/2024 + $ 1,272.30

BALANCE DUE AS OF 12/29/2025$142,450.10Call Collections@877-249-8297

Brad Reynolds "Salesperson"

"Relationship Builder"

TOP PICTURE - MUG SHOT YEARS in PRISON (2002-2005) Probation

(2006-2014) Prison

BELOW - PICTURES YEAR (2022-2023)

" YOUTUBE GOOGLE" Video claiming the position of

"Relationship Builder"

Salesperson claimed

Having 18 years of experience in the Automotive sales industry

has

been removed by

Honda of Tomball Dealership

Fired

Brad Reynolds continued

LIES

* Reference years

Incarcerated below

* Bradley Houston Reynolds

iconic quote in accordance with

past 18 victims,

" YOU CHOSE VIOLENCE

INSTEAD OF PEACE

THAT'S NOT WHAT I DO."

2022, 2023, 2024, 2025

LIES AND DECEPTION CONTINUED

BELOW

HAS NO COLLEGE DEGREE

AS CLAIMED

"A conviction for Fraudulent, Substandard, or Fictitious Degree in Texas is punished as a Class B misdemeanor, with a maximum possible fine under Texas state law of up to $2,000 and jail time of up to 180 days."

Feb 1, 2024

12/29/2025

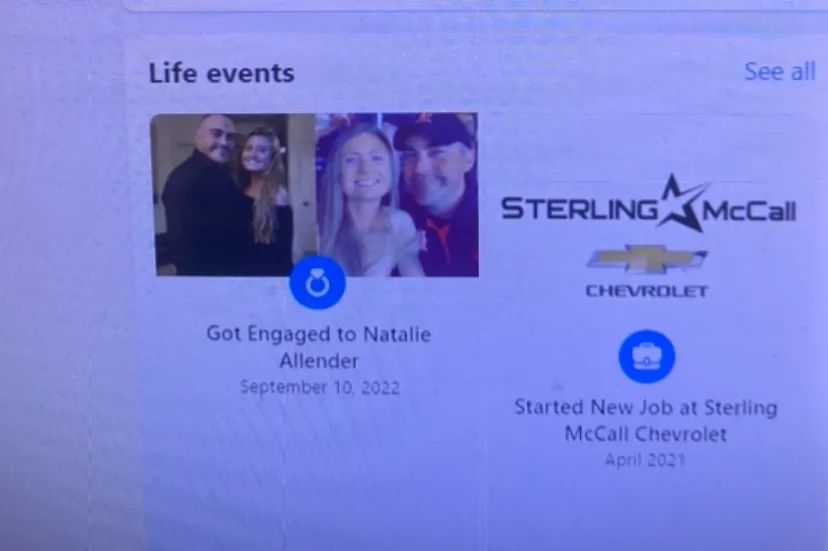

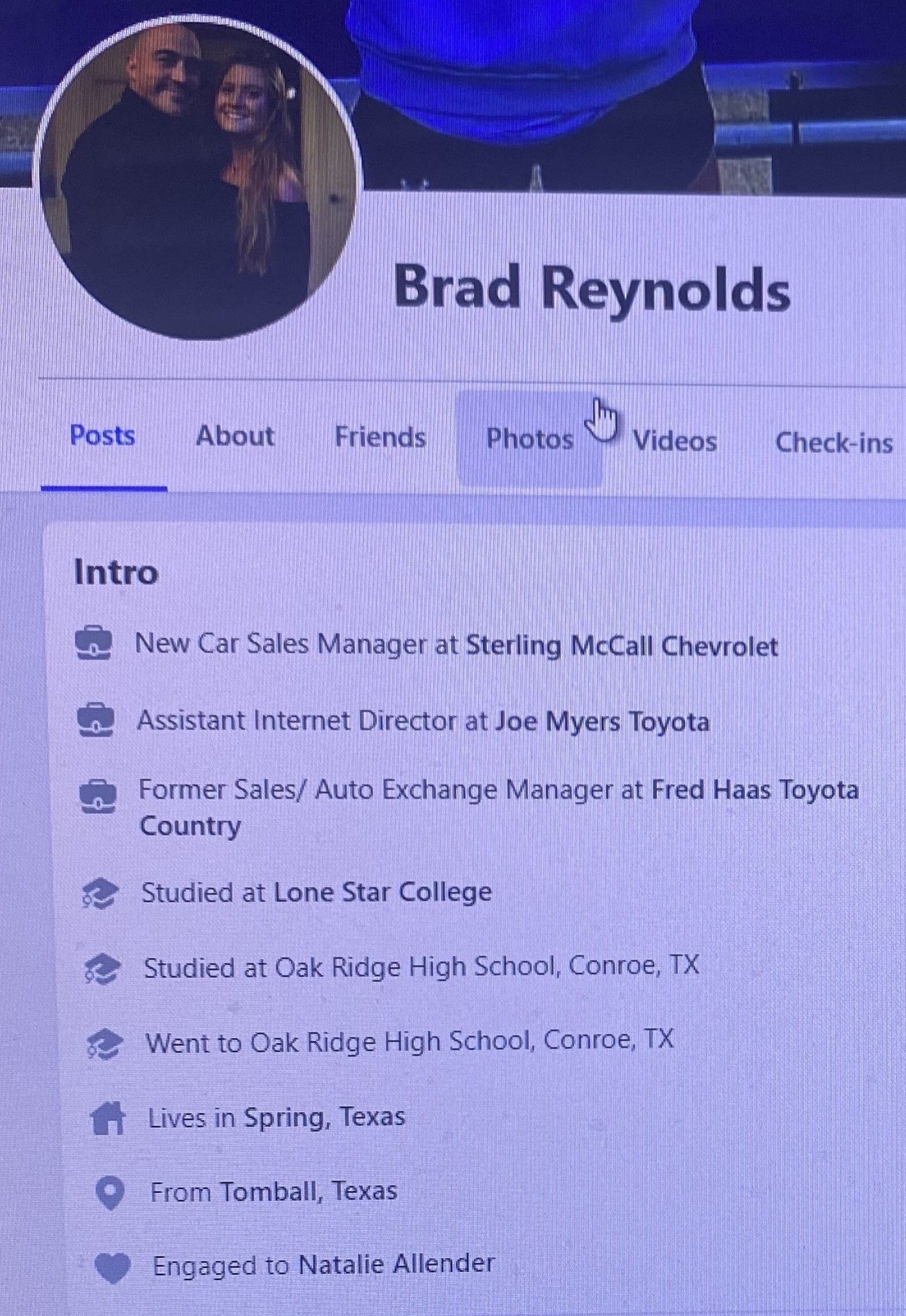

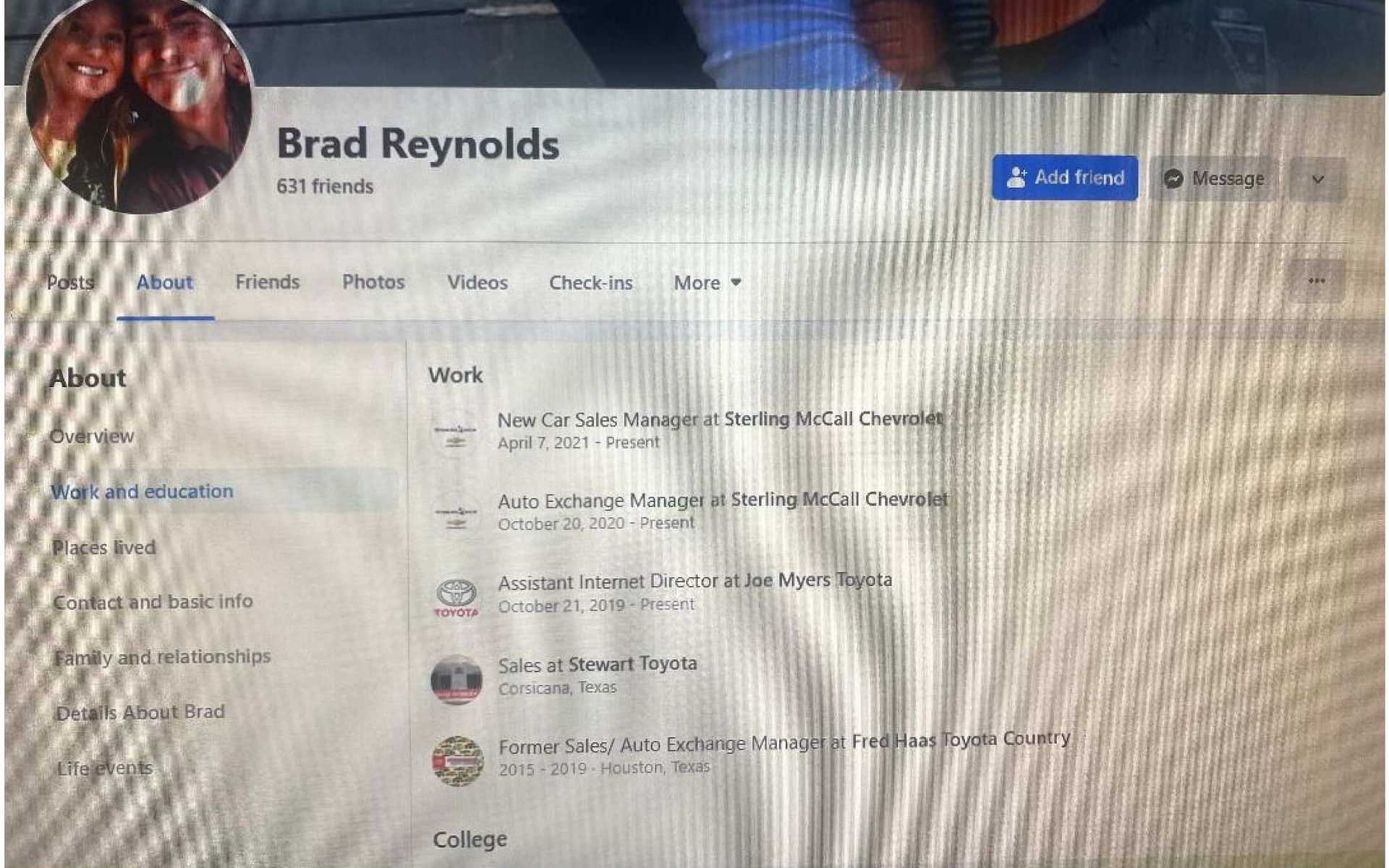

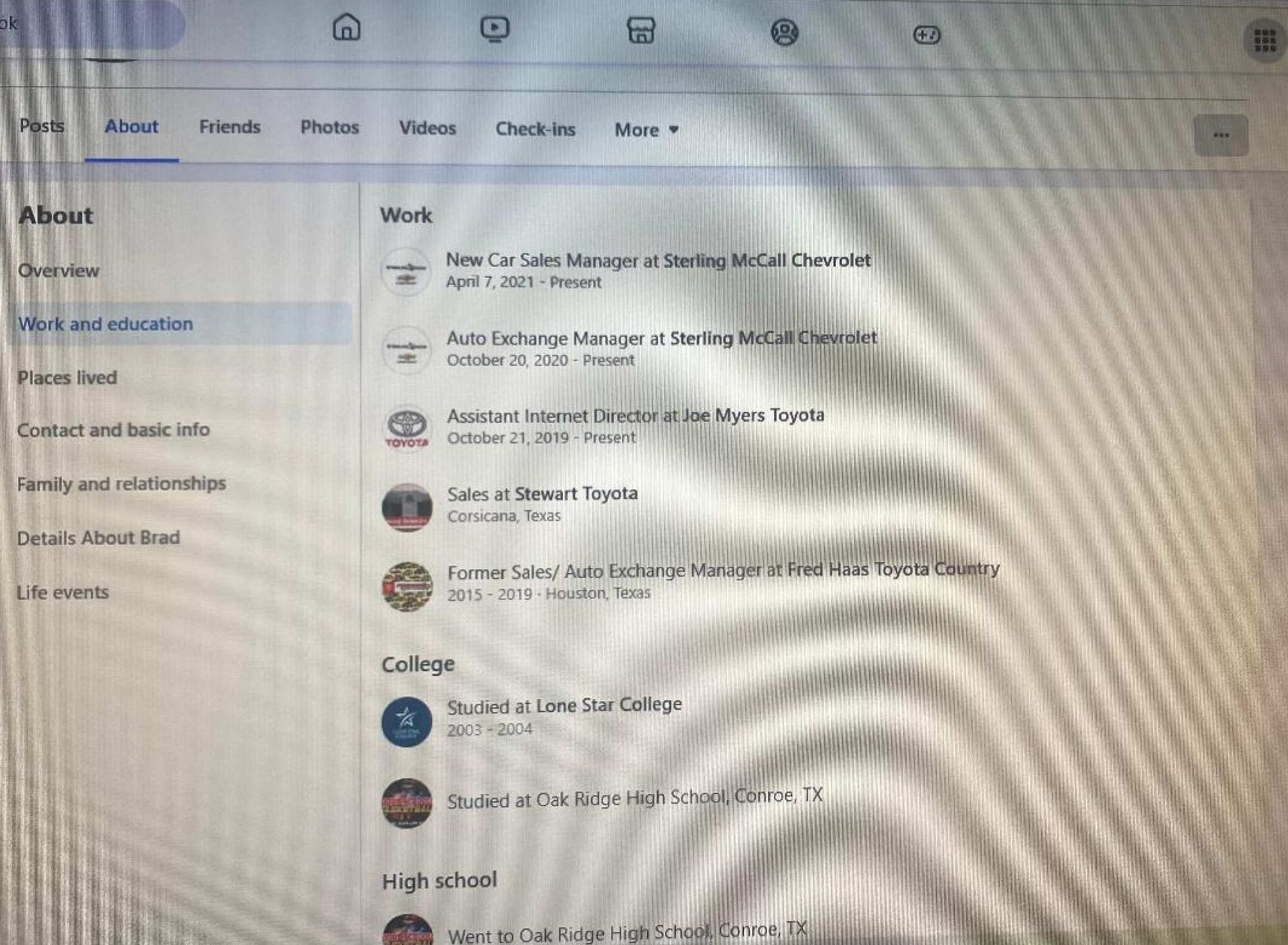

Bradley Houston Reynolds below PICTRURES can not keep up with

his own

Stories or Lies

- First picture - engaged to a different woman 09/10/2022 https://www.instagram.com/nataliereynolds2000/,https://www.facebook.com/BHR40. False picture of Bradley Houston Reynolds with engaged girl, This pictured he was Already fired by Sterling McCall Chevy and Not employed by them, Then employed by Tomball Honda Sales person / called a Relationship Builder!

First picture-Started Sterling McCall Chevrolet Started April 2021 - NOT STEPTEMBER 2020-- INTERNET SALES

1. First Picture, bottom-Forgot he was a Relationship Builder - Sales person Tomball Honda

- Third picture - uses deceased wife Brittany N Pelton who died 10/18/2020,

- https://www.dignitymemorial.com/obituaries/tyler-tx/brittany-pelton-9911141.

- https://www.facebook.com/drivewithbradatjoemyerstoyota/

- https://www.dealerrater.com/dealer/Fred-Haas-Toyota-Country-dealer-reviews-17217/page13/

- Third picture- Displayed Deceased Second wife on LinkedIn as current wife 2024: https://www.linkedin.com/in/brad-reynolds-225676217

- Second picture- listed Brad Reynolds as Sales Manager but was only Internet assist Manager at Sterling McCall Chevy, Group 1 Automotive verified

- Second picture- claims Sales/Auto Exchange Manager at Fred Haas Toyota. But only was a sales person.

- Third and Forth pictures- claims he was Sales Manager at Fred Haas Toyota was a sales person.

- Second Picture - claims studied at Lone Star College, but never attended or graduated from Lone Star college

- Third and Forth Picture- side claims he has Associate Degree Business Administration and Management General, Lie Has No Colledge Degree

- Was in prison

- Second, Third And Forth Picture- Never attended or graduated from Lone Star college

- Lone Star College-System Office

5000 Research Forest Drive

The Woodlands, Texas 77381

832.813.6500

"A conviction for Fraudulent, Substandard, or Fictitious Degree in Texas is punished as a Class B misdemeanor, with a maximum possible fine under Texas state law of up to $2,000 and jail time of up to 180 days."

Feb 1, 2024

TERMINATED 2021

This fake card was created by Bradley H Reynolds

Was not with this girl when employed with Sterling McCall Chevy

TERMINATED IN 2021 CHEYY INTERNET ASSISTANT MANAGER

CLAIM STUDIED AT LONE STAR COLLEGE NEVER ATTENDED, WAS IN PRISON

NEVER SALES MANAGER

NEVER ASSIST SALES MANAGER

NEVER SALES MANAGER

SALES PERSON CORRECT

Never attended college, no Degree, He can't even keep his lies correct

The latest fabricated lies continue

below

Was an Internet Manager at Sterling McCall Chevy Claimed to be in college while in prison, 2003-2004 Terminated September 2021 Released from prison in 2006

https://www.dealerrater.com/dealer/Fred-Haas-Toyota-Country-dealer-reviews-17217/page13/

https://www.facebook.com/DriveWithBrad/

Penal Code Section 32.52

Fraudulent, Substandard, or Fictitious Degree

(a)

In this section, “fraudulent or substandard degree” has the meaning assigned by Section 61.302 (Definitions), Education Code.

(b)

A person commits an offense if the person:

(1)

uses or claims to hold a postsecondary degree that the person knows:

(A)

is a fraudulent or substandard degree;

(B)

is fictitious or has otherwise not been granted to the person; or

(C)

has been revoked; and

(2)

uses or claims to hold that degree:

(A)

in a written or oral advertisement or other promotion of a business; or

(B)

with the intent to:

(i)

obtain employment;

(ii)

obtain a license or certificate to practice a trade, profession, or occupation;

(iii)

obtain a promotion, a compensation or other benefit, or an increase in compensation or other benefit, in employment or in the practice of a trade, profession, or occupation;

(iv)

obtain admission to an educational program in this state; or

(v)

gain a position in government with authority over another person, regardless of whether the actor receives compensation for the position.

(c)

An offense under this section is a Class B misdemeanor.

(d)

If conduct that constitutes an offense under this section also constitutes an offense under any other law, the actor may be prosecuted under this section or the other law.

Added by Acts 2005, 79th Leg., Ch. 1039 (H.B. 1173), Sec. 8, eff. September 1, 2005.

Source: Section 32.52 — Fraudulent, Substandard, or Fictitious Degree, https://statutes.capitol.texas.gov/Docs/PE/htm/PE.32.htm#32.52

(accessed Jun. 5, 2024).

EXCON Salesperson

BRAD REYNOLDS

is now A

Finance manager / DIRECTOR

at Dealership:

Victoria Dodge Jeep Ram

Victoria, Texas

MASSIVE ILLEGAL PUBLIC AND BANK FRAUD

WARNING!

CONTACT FTC, FBI, VICTORIA POLICE

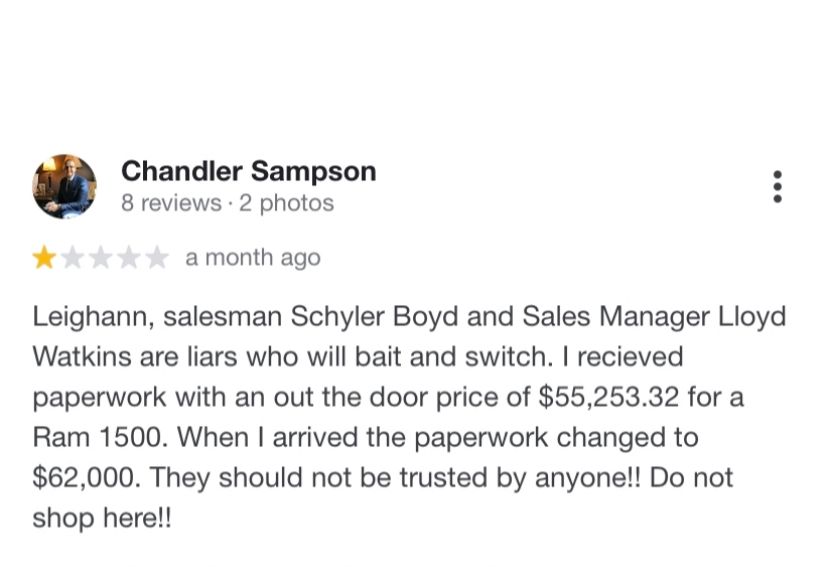

"BOGUS RANDOM EXTRA FEES"

Have you been victimized by Bradley Houston Reynolds?

(AKA) , Brad Reynolds Victoria, Texas

Continuous FRAUD, 100% Automotive finance fraud

(AKA) Brad H Reynolds, Brad Houston Reynolds

FILE REPORT WITH FTC, FBI, VICTORIA POLICE, MONTGOMERY POLICE, IRS,

https://reportfraud.ftc.gov/#/

Victoria Police 361-485-3730.

FBI 361-575-6277

FTC

Non-compliance can lead to fines of up to $100,000 per violation.

"Federal Trade Commission

If Finance Manager, or Manager(s) claimed aftermarket products purchases are required by lenders, or the dealership, or Government Fees, or claimed Government Taxes, requirements to purchase automobiles,

MASSIVE FRAUD

WALK AWAY

&

REPORT

Stop the Fraud by Finance managers and Sales Managers.

ALL DEALERSHIP FINANCED CUSTOMERS

NEED TO REQUEST COPIES OF YOUR PURCHASE CONTRACTS FROM YOUR FINANCE LENDER.

When you receive your first payment request from the lender,

Call your

BANK OR "FINANCE COMPANY " AND REQUEST COPIES OF ALL PAPERWORK.

The Finance lender will Mail or email you all of your paperwork copies they have and used for approval of the loan.

This Paperwork from your Lender is FOR FUNDING THE LOAN and will prove any forgery's and discrepancies.

Then compare the Contract, Buyers Purchase Order, CASH down or Down Payment, Signatures and all papers you received from the Dealership to your Finance lenders paperwork.

Check all fees both CLAIMED Taxable and Non Taxable check where they were applied on contract, Check the Selling price and check What Aftermarket products were added. If Manufacture offered a customer rebate it must be disclosed as down payment with cash down-payment.

For any discrepancy's including fraud, forgery, Signatures, non disclosed products,

Trade values, Dealer Fees, Taxable Fees, Non Taxable Fees, Money, down payment and all unwanted aftermarket products, buyers order, any changes in paperwork must have all signatures for each buyer on all papers

IMPORTANT DO NOT LEAVE THE DEALERSHIP WITHOUT COPIES OF ALL PAPERWORK YOU SIGNED, NO EXCEPTIONS.

Contact and Report the Fraud to the FTC, Victoria Local Police, FBI, and Ken Paxton General Attorney, United States Attorney Monty Wilkinson , Greg Abbott - Governor of Texas, Ted Cruz- Senator, Texas Rep Joan Huffman- District 17,

Geanie W Morrison District 30

https://reportfraud.ftc.gov/#/

13 WAYS DEALERSHIPS COMMIT FRAUD

LINKS BELOW

https://www.youtube.com/watch?v=nYG7565CxG8

Research Google Reviews and Facebook Reviews for dealership purchases before you purchase.

https://www.facebook.com/victoriadodgechryslerjeep/reviews/?ref=page_internal&locale=en_GB

Dealership removed the active link of the cover up the SCAM!

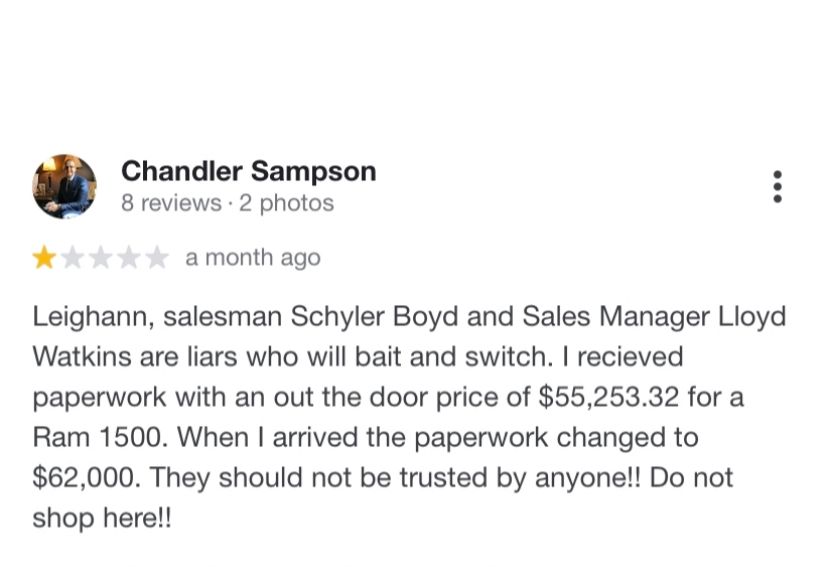

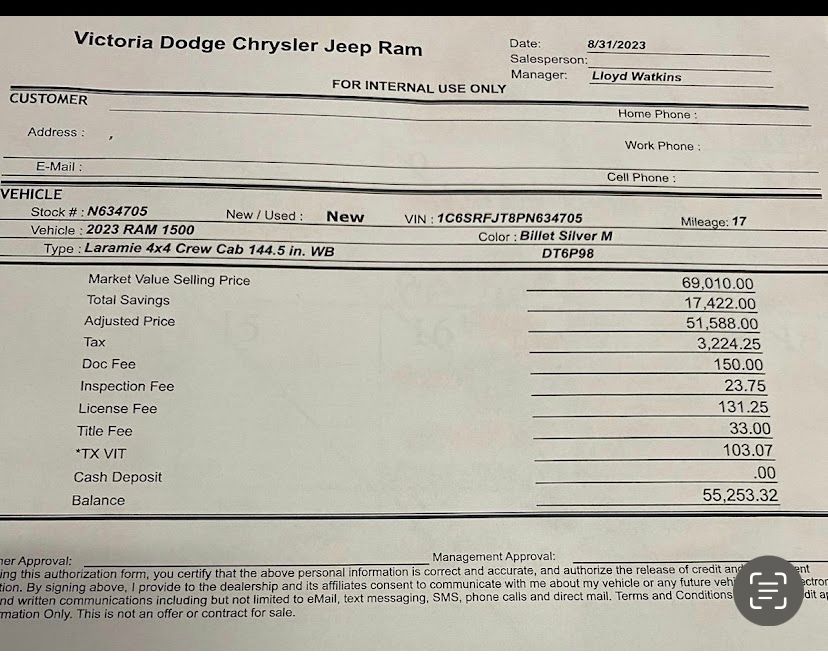

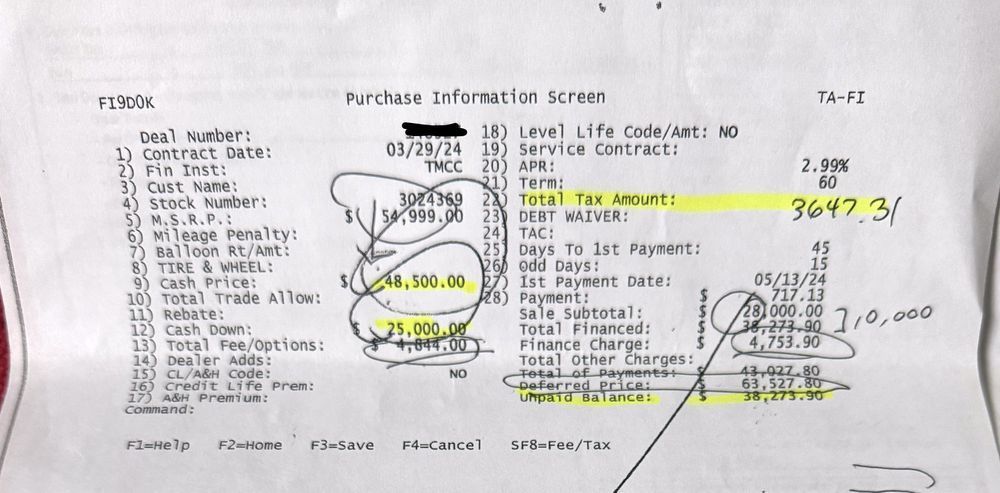

After questioning amount financed,

Customer was told all fees

are required by The

DEALERSHIP TO BUY VEHICLE

& ARE NON-NEGOTIABLE!

F & I FRAUD !

SMART CUSTOMER - WALKED OUT !

ASK FOR BUYERS / PURCHASE AGREEMENT !

This is a complete breakdown of all charges charge for the purchase of vehicle. -- BUYERS PURCHASE ORDER

Make sure finance manager signs all documents provided to you.

WHEN NEGOTIATING

DO NOT LET THE DEALERSHIP DISPLAYED AND USE A FRAUDULENT WORKSHEET AS SHOWN ABOVE!

REQUEST TO SEE AND WORK FROM THE TRUE BUYERS ORDER.

THE WORKSHEET ABOVE CONTAINS MASSIVE FRAUD.

FORGERY,

Deception, Packing and Fees:

IS

100% ILLEGAL !

REPORT THE FRAUD

TO THE

THE FTC, FBI AND LOCAL POLICE

Brad H Reynolds was the Finance Manager

www.facebook.com/victoriadodgechryslerjeep/reviews/?ref=page_internal&locale=en_GBaph

DEALERSHIP REMOVE LINK

LINK TO LISTING https://texags.com/forums/46/topics/3272009

"In my opinion, Keating Toyota in Manvel scammed my almost 80 year old parents of almost 20k

My Senior parents had been looking for a minivan (Sienna). Found one online at Keating and agreed to price on email. They arrived at the dealership and were given the classic bait and switch We just sold it 5 minutes ago". They then convinced them that they could get one in the dealership the next day. Claimed it just happened to be coming in.

They agreed on a price that seemed reasonable. They came back the next day and went over the numbers. Everything seemed correct and in order. They were taken to the typical finance upsell foolishness. Refused the add ons. The paperwork was all on an in desk computer screen. The finance guy said he written numbers they agreed on would just be input into the computer. They weren't shown any new numbers on the screen and assumed it was the same as the paper they had been looking at because that is what they were told. They were not shown any changes on the computer screen. They signed it electronically. My dad asked for copies of what they signed. They refused and said they were only allowed to put the paperwork on a thumb drive.

They left and took the vehicle home. When they opened up the flash drive paperwork, almost 20k of scam warranties, APEX GPS etc had been added on. Unfortunately, they didn't tell me they they were buying the car and I was caught off guard by this level of brazen fraud. Preying on elderly folks like this is beyond the pale and makes me sick to my stomach.

Looking at online reviews, this seems to be a common scam they are running. Naturally they are refusing to talk to them or return calls etc. What recourse do they have here? Complaint to AG? Anyone experienced similar with elderly parents?"

Keating Toyota scammed my

elderly parents

TexAgs Forums:

https://texags.com/forums/46/top

WARNING OF

FRAUDULENT ACTIVITY!

BRAD REYNOLDS, BRADLEY H REYNOLDS:

FINANCE MANAGER

FINANCE FRAUD

REQUIRED THE REAL CUSTOMER TO

PURCHASE ALL

"CLAIMED" - (MANDATORY) OPTIONAL products to the

amount of $12,000+.

Then created

TWO FORCED DEALERSHIP STRAW PURCHASES

by enticing the hands-on buyer that,

"You do not want high interest rates".

The Finance Manager

BRAD REYNOLDS

then put both purchases under the

girlfriend's name only

which led to the so-called

"requirement" of these

apparent "optional" products.

With these forced products being visible on the

paperwork as the girlfriend was signing,

Which caught the attention of the

hands-on consumer, Boyfriend who emphasized that he had

no intention, nor desire to purchase these unwanted

Apex add-ons.

Not wanting to purchase the required add-ons, he

was met with the ultimatum of either purchasing

the vehicle with all fees and unwanted extras, or he

couldn't purchase the vehicle. Manager then states

when your

new truck comes in he will transfer all products to

his new truck again requiring adding additional not

wanted optional APEX products.

However, the trade-in

was in the hands-on consumer's, BOYFRIENDS name

ONLY! ,

creating

an illegal trade in, not in purchasers name.

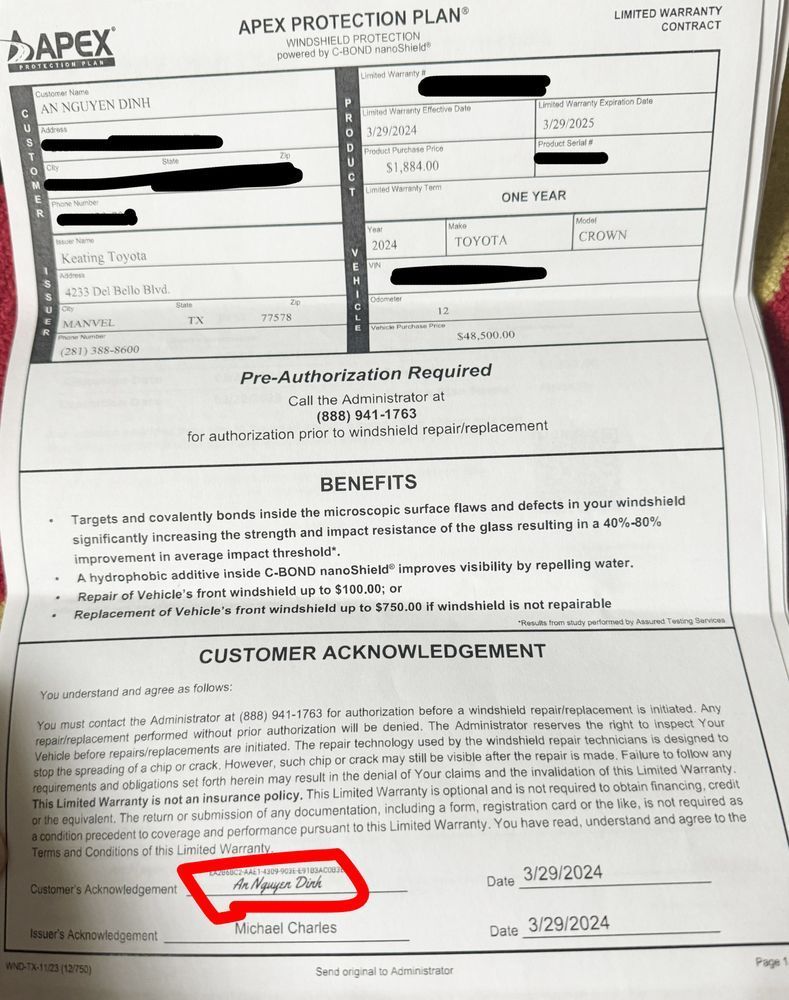

Committing SALES TAX FRAUD & CREDIT FRAUD

APEX PROTECTION, INC.

5802 N Navarro St Suite 200,

Victoria, TX 77904

General: (888) 376-8940

Claims: (888) 941-1763

Claims Fax: (361) 485-0562

Info@ApexProtectionPlan.com

https://apexprotectionplan.com/

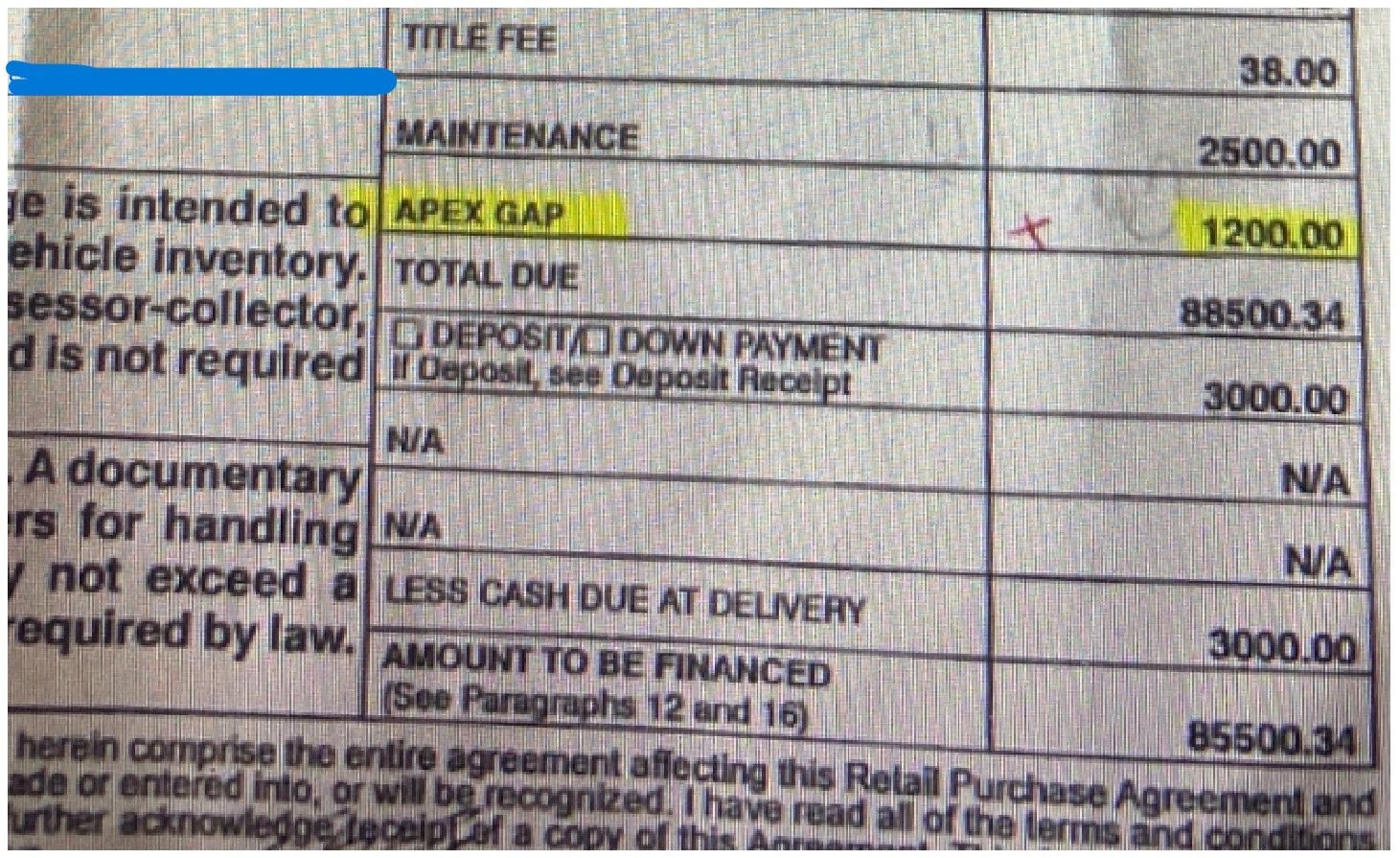

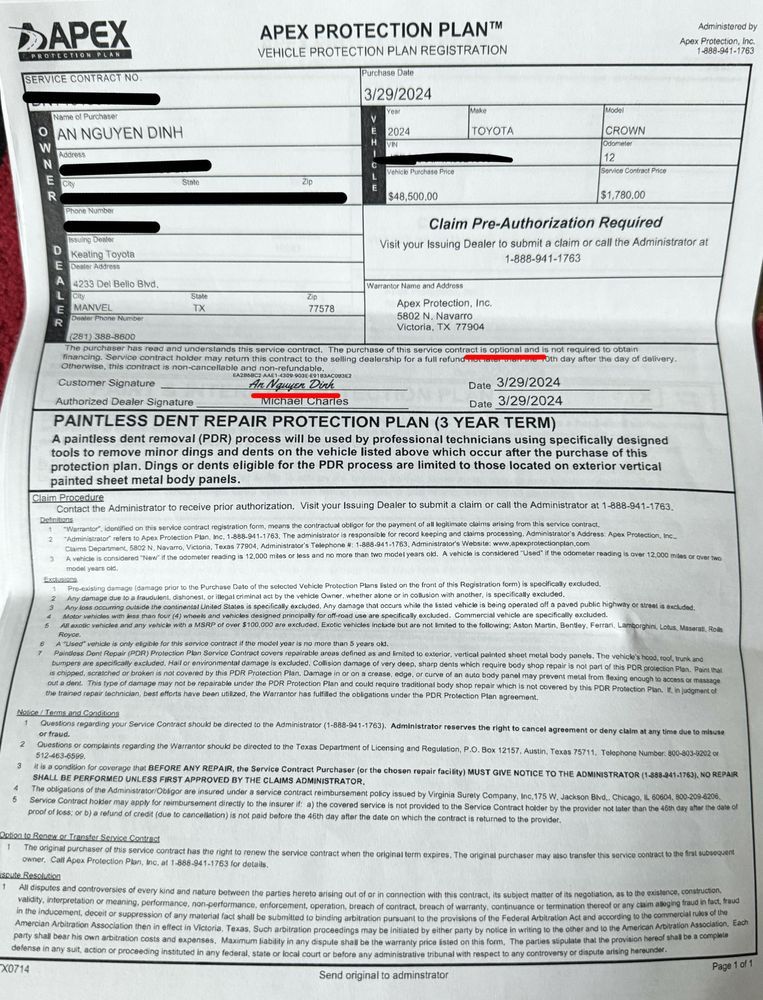

*REFERENCE DETAILS BELOW

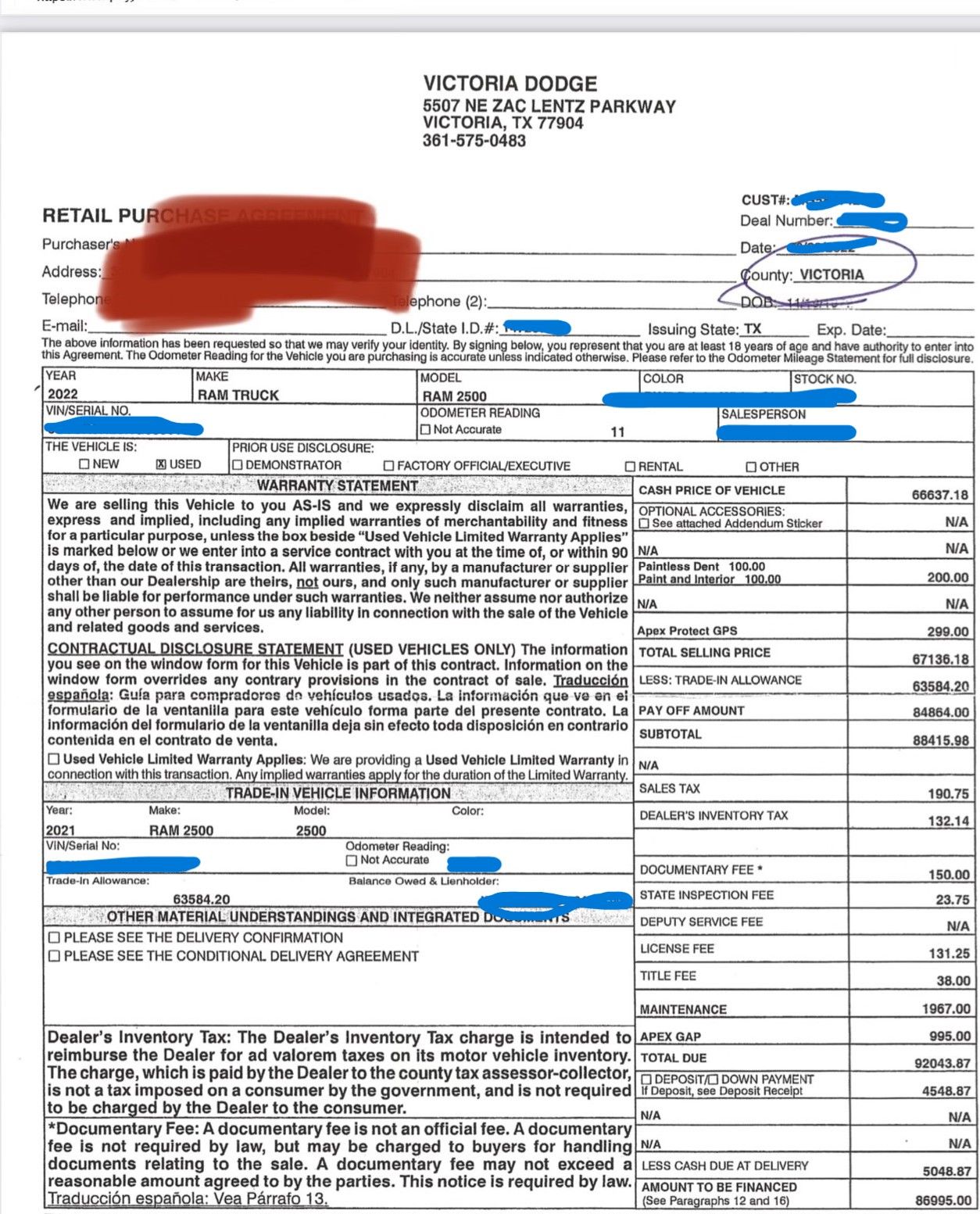

THE REVIEW

AND

2 STRAW-100% ILLEGAL

PURCHASE ORDERS,

USED TRUCK AND NEW TRUCK

FIRST STRAW PURCHASE ABOVE

PICTURE

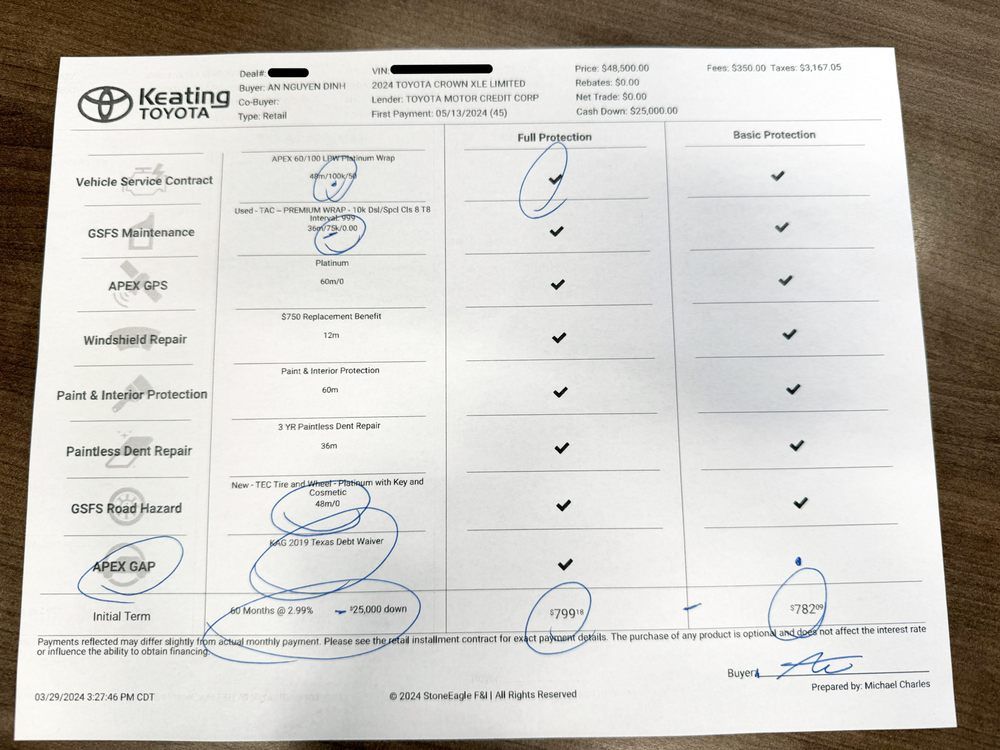

LIST OF (MANATORY) BUT ARE OPTIONAL AFTERMARKET PRODUCTS

PAINTLESS DENT, PAINT & INTERIOR, WINDSHIELD PROT, APEX GPS, TIRE & WHEEL, APEX, MAINTENANCE, APEX GAP; VEHICLE 1: TRUCK PURCHASED -- PRE-OWNED

APEX UNWANTED PRODUCTS DEALERSHIP FINANCE DEPARTMENT ADDED: $12,488.00

"Security and Peace of Mind Protection for a few extra dollars per month – Apex Protection Plan has the perfect coverage for every budget. Apex Protection Plans are designed with you in mind".

https://apexprotectionplan.com/

75 month loan = $166.50 per month extra!

"A few extra dollars per month" DECEPTION AND FRAUD

LIST OF DEALERSHIP (MANATORY) OPTIONAL AFTERMARKET PRODUCTS

( VEHICLE 2 BELOW INFORMATION )

PAINTLESS DENT, PAINT AND INTERIOR, APEX PROTECT GPS, MAINTENANCE, APEX GAP TRUCK PURCHASED --A PRE OWNED

APEX PRODUCTS ADDED $ 3,461.00 ( VEHICLE 2)

1ST AND 2ND VEHICLE CASH LOST $ 3,OOO.00

SELLING PRICE WAS ALSO INCREASED BY (VEHICLE 1 ) $ 3,000.00

NEGATIVE EQUITY FROM TRADE IN ( VEHICLE 1 ) $ 2,700.00

TRADE DEPRECATION $ 6,413.80

TOTAL OF APEX PRODUCTS ( VEHICLE 1 ) $ 12,488.00

LESS APEX CANCELLATIONS REFUND TO DOWN PAYMENT $ -9,597.57

APEX PRODUCTS DEPREATION ADDED (2 months ) $ 2,890.43

LESS FEES $ -665.89

$66,637.18 TRUCK NOW FINANCING

$86,995.00

BELOW (VEHICLE 2 )

NEW TRUCK

STRAW

PURCHASE

Apex claims

"Peace of Mind Protection" $20,000+

"Security and Peace of Mind Protection for a few extra dollars per month – Apex Protection Plan has the perfect coverage for every budget. Apex Protection Plans are designed with you in mind".

https://www.dictionary.com/e/few-vs-couple-vs-several/

https://apexprotectionplan.com/

Apex Protection Plan

https://www.yelp.com/biz/apex-protection-plan-victoria

A vehicle that was stolen from Victoria Dodge at 8:00 a.m. Tuesday, recovered in an apartment complex in Houston later that morning. Victoria Dodge general manager James Law says ,

The truck was found using the Apex GPS system that is installed on all of Victoria Dodge’s vehicles.

Installed at whose cost!

and was it listed on the Addendum Sticker ?

Was it an "Addendum sticker DISCLOSED ITEM ADDED at a dealership?

"Victory Dodge Jeep Ram Wagoneer general manager JAMES LAW states GPS ADDED TO EVERY CAR"

The addendum or dealer add-on sticker is a dealership created sticker that will contain various high profit and/or overpriced accessories or products to add profit to the vehicle for sale. An addendum sticker is conveniently placed beside the large Manufacturer's Suggested Retail Price (M.S.R.P.)

DO CUSTOMERS KNOW TRACKING EVERY CAR !

A few means a small number. (“ I have fewer than you”/”they are few and far between”) Several, according to its dictionary definition means “more than two but not many”, so a few but not a couple.

If you run an auto dealership, accounting service, or one of many other

impacted businesses, you may be surprised to hear that the FTC has

broadened its definition of “Financial Institution” to include… you.

Under these new rules, you are now beholden to strict compliance

standards beginning on June 9, 2023.

And failure to do so could cost you

$46,517 per violation, OR

a seven-figure FTC-backed civil lawsuit, and

reputational damage that can be more costly still.

Non-compliance can lead to fines of up to $100,000 per violation.

"Federal Trade Commission"

Consequences of FTC regulations violation

As we all know that the security of data is utmost important for any individual or company. Hence, it becomes essential for any organization to strictly follow the FTC safeguard rule. And, we can’t ignore the fact that the consequences of not complying with the FTC Safeguards Rule can be serious like:

Your company will be subject to significant fines, and its reputation may be damaged.

As of June 2023, the FTC will be allowed to impose fines of up to $100,000 per violation under updated guidelines.

You may also face lawsuits from unhappy customers and employees, which could further harm your business' reputation.

Non-compliance can lead to fines of up to $100,000 per violation.

"Federal Trade Commission"

Notice/Awareness. All consumers must be notified that an entity plans on collecting data from those consumers, and that the entity has policies in place regarding how that data will be used. It varies from state to state, however, as to how much notice an entity must give.

- Choice/Consent. Consumer must be allowed to opt-in or opt-out of a company’s plans to use/disseminate their data. In other words, “choice means giving consumers options as to how any personal information collected from them may be used.”

- Access/Participation. Consumers must be allowed to see how their data is being used, and they must be allowed to contest any inaccurate or incomplete information.

- Integrity/Security. All entities must take the proper steps to ensure that consumers’ personal data is safe and secure.

- Enforcement/Redress. These steps mean nothing if they are not enforced, or if there is no policy in place for correcting errors and holding entities responsible for those errors.

According to the FTC Act, “Unfair” practices are defined as those that “cause or

[are] likely to cause substantial injury to consumers which is not reasonably avoidable by consumers themselves and not outweighed by countervailing benefits to consumers or to competition” (15 U.S.C. Sec. 45(n)).It is important to note that while consumers suffer losses with regard to deceptive business practices, so do other businesses.

The Federal Trade Commission (FTC) seems to be in full assault mode when it comes to regulating auto dealers. It is doing so by proposing new rules and by entering consent decrees with allegedly offending dealers.

The FTC defines “junk fees” as “unfair or deceptive fees that are charged for goods or services that have little or no added value to the consumer, including goods or services that consumers would reasonably assume to be included within the overall advertised price.” It is unclear who would make this interpretation and what would be necessary to defend a fee to the FTC.

The FTC has also been active on the rulemaking front. In June, it issued a proposed Trade Regulation Rule affecting auto dealers. The proposed rule was styled to ban junk fees and bait-and-switch advertising tactics. A dealer would have to disclose in advertising and communications a true “offering price” for a vehicle that would be full price a consumer would pay, excluding only taxes and government fees. With this proposed rule, the FTC appears to be particularly pushing the elimination of junk fees, bait-and-switch ads, add-ons with no value, worthless aftermarket product, and mew disclosures to purportedly level the playing field.

The Trade Regulation Rule would also prohibit dealers from charging consumers “junk fees” for fraudulent add-on products and services that provide no benefit to the consumer such as “nitrogen filled” tires that contain no more nitrogen than normal air. The proposal would prohibit dealers from charging consumers for an add-on without their clear, written consent and would require dealers to inform consumers about the price of the car without any of optional add-ons.

In October, the FTC indicated its intention to publish a rule banning junk fees and other practices. The Rule targets unnecessary charges for worthless, free, or fake products or services; unavoidable charges imposed on captive consumers; and surprise charges that secretly push up the purchase price. One way the FTC described these fees was as follows:

Consumers can experience junk fee shock when companies unexpectedly tack on mystery charges they did not know about, consent to, or factor into the purchase. Companies might hide these fees in the fine print, cram them on at the end of a purchase process, or use digital dark patterns or other deception to collect on them. Some companies might claim that they do not charge any fees and then add on fees after the purchase or sign up.

In taking these actions, the FTC made unsupported broad generalizations about auto dealer behavior and undertook to expand its authority under Section 5 of the FTC Act which prohibits unfair and deceptive practices (UDAPs). The FTC claims that disparate impact credit discrimination is a UDAP. This ignores the law where the Equal Credit Opportunity Act (ECOA) is the only federal law on credit discrimination and the U.S. Supreme Court indicated in a 2015 opinion that statutory language like that which appears in ECOA does not support disparate impact but only intentional discrimination.

In taking these actions, the FTC appears to be usurping the legislative process that our Constitution provides to the Congress. The FTC also interprets laws — a power the Constitution confers on the judiciary — to expand its authority in a way that no Court has done The FTC knows that no auto dealer is going to finance a costly lawsuit to strike down its interpretations and there don’t appear to be any trade associations willing to take on the battle either.

Where does the FTC fit in? The FTC is another agency outside of the DOJ. Contrasting to the FBI which focuses on outright criminal activity like theft or money laundering, the FTC is responsible for more subtle issues like deception and ensuring dealerships operate fairly and honestly in the treatment of consumers. FTC investigates issues like honest advertising, proper disclosures, fairness, and transparency. This is done through the “Consumer Protection Unit”.

Further contrasting to the FBI, the FTC can do both investigation and prosecution of car dealerships! The FTC has its own in-house attorneys to handle this. The limitation is the FTC can only prosecute a dealership in civil court, but not criminal court. This means the FTC can only sue dealerships for outcomes like monetary relief and/or injunctions. If an issue merits criminal prosecution (e.g. someone may need to go to jail) then the FTC will refer it to the Department of Justice (DOJ) which can prosecute a dealership in criminal court through the US Attorney’s office." https://www.linkedin.com/pulse/car-dealership-fraud-deceit-investigation-prosecution-wortman-msc

https://www.ftc.gov/enforcement Report Fraud https://reportfraud.ftc.gov/#/

BRADLEY HOUSTON REYNOLDS INDICTMENTS BELOW

Cause No 07-02-02097CR

As of this date, 07/15/2025, --- NO Restitution balance of $142,450.10 Has NOT been paid.

TRANACTION ASSESSMENT ADDED

05/05/2024 $ 32,873.10

06/25/2024 $1,272.30

NEW TOTAL

12/29/2025 $142,450.10

Ex-Con, Bradley Houston Reynolds (AKA) BRAD REYNOLDS, BRAD H REYNOLDS, BRAD HOUSTON REYNOLDS, BRADLEY REYNOLDS, BRADLEY H REYNOLDS,

https://twitter.com/tiderider51

https://twitter.com/tiderider51?lang=en

for any of the 8 victims listed in the 2007 judgement and order Still after selling 2 homes for $900,000.00 this year, and buying a new home on 9/16/2022 for $394,790.00--$465,700.00

| JUDGEMENT | JUDGEMENT | INTEREST |

|---|---|---|

| AMOUNT | DATE | INDICTMENT |

| $ 112,000.00 | 10/11/2007 | INCARCERATED |

| JUDGEMENT | SIGNED | YRS 2005-2014 |

| $ 109,577.00 | BALANCE | 04/04/2024 |

| $ 32,873.10 | Transaction Assessment | 04/05/2024 |

| $ 1,272.30 | Transaction Assesment | 06/25/2024 |

| $ 145,450.10 | TOTAL ASSESSMENT | 12/29/2025 |

| $ - 2.705.00 | PAYMENT /CREDIT | 03/17/2020 |

| $142,450.10 | BALANCE DUE | 07/15/2025 |

| 6 % INTEREST | JUDGE DESIDES | FUTURE INTEREST |

Statement with the victim's payout

Payments below as of 12/29/2025

Record Count:6Search By: Defendant Use Soundex: on Party Search Mode: Name Last Name: Reynolds First Name: Bradley Middle Name: Houston Date of Birth: 04/05/1985 All All Sort By: Filed Date Case Number Citation Number Defendant InfoFiled/LocationType/StatusCharge(s)05-12-11390REYNOLDS, BRADLEY HOUSTON

04/05/1985

12/29/2005

359th Judicial District Court

Adult Felony - Filed by Indictment

Disposed

THEFT OF STOLEN PROPERTY06-01-00773REYNOLDS, BRADLEY H.

04/05/1985

01/26/2006

359th Judicial District Court

Adult Felony - Filed by Indictment

Disposed

THEFT06-03-02739REYNOLDS, BRADLEY HOUSTON

04/05/1985

03/23/2006

359th Judicial District Court

Adult Felony - Filed by Indictment

Disposed

THEFT06-05-04518REYNOLDS, BRADLEY HOUSTON

04/05/1985

05/11/2006

359th Judicial District Court

Adult Felony - Filed by Indictment

Disposed

THEFT07-02-02097REYNOLDS, BRADLEY HOUSTON

04/05/1985

02/27/2007

359th Judicial District Court

Adult Felony - Filed by Indictment

Disposed

AGGREGATE THEFT07-03-03195REYNOLDS, BRADLEY HOUSTON

04/05/1985

03/29/2007

359th Judicial District Court

Adult Felony - Filed by Indictment

Disposed

BURGLARY OF HABITATION

Bradley (Brad) Houston Reynolds,

is on the

Government Watch list

Reference 6 Links Below:

Restitution - Montgomery County District Attorney's Office

https://montgomeryda.com/departments/restitution/

Cause No. 915573 11/11/2002 Theft 4 years Deferred Adjudication of Guilt , community supervision

184 TH District Court of Harris County, Texas $ 600.00 Fine Paid

Cause No 1021821 03/31/2005 Theft; Dismissed

184 TH District Court Of Harris County, Texas

Cause No 06-01-00773 01/26/2006

359 TH District Court of Montgomery County, Texas Theft, Indictment, Dismissed, convicted in cause 07-002097

Cause No 06-03-02739 03/23/2006

359 TH District Court of Montgomery County, Texas Theft, Indictment, State Jail, Dismiss , convicted in cause 07-02-02097

Cause No 06-05-045118 09/21/2006

357 TH District Court of Montgomery County , Texas Theft, Indictment, State Jail, Dismiss, convicted in cause 07-02-02097

Cause No 07-02--297-CR Aggregate Theft BRADLEY HOUSTON REYNOLDS

(AKA)

BRAD REYNOLDS, BRAD H REYNOLDS, BRAD HOUSTON REYNOLDS, BRADLEY REYNOLDS, BRADLEY H REYNOLDS,

https://twitter.com/tiderider51

New Balance as of 11/21/2024 $142,450.10 Collections @ 877-249-8297

According to Section 31.09 of the Texas penal code, aggregate theft occurs when an individual commits two or more thefts “pursuant to one scheme or continuing course of conduct, whether from the same or several sources.”

What Constitutes a Lie

A lie doesn't necessarily have to be an outright false statement. Omissions can be just as dishonest as an out-and-out lie. It's suggested that the education section of the resume is where embellishments are most frequent. This often comes in the form of an individual claiming that they have completed an educational program that they may have only started or never achieved. Embellished titles, exaggerated job duties, altered dates of employment, altered residential history, false references, false creation of income checks, false tax returns and use of multiple cell phones for lies are also common. Then utilizing the Internet to promote the fraud.

INVESTIGATE BACKGROUND!

https://www.facebook.com/BHR40

Claims still working at Sterling McCall Chevy

April 7,2021 -September 2021

Terminated

Intro

New Car Sale ( Relationship Builder) Tomball Honda- Sales Person

- New Car Sales Manager at Sterling McCall Chevrolet - False Internet Manager

- Assistant Internet Director at Joe Myers Toyota - Fales Sales Person

- Former Sales/ Auto Exchange Manager at Fred Haas Toyota Country- False Sales Person

- Studied at Lone Star College- NEVER ATTENDED

- Studied at Oak Ridge High School, Conroe, TX G.E.D

- Went to Oak Ridge High School, Conroe, TX

- Lives in Spring, Texas, -False Now Victoria Texas

- From Tomball, Texas

2 months at Tomball Honda Relationship Builder "Salesperson"

VIDEO BELOW

Application claims Attended Lone Star College -False, Pending Refund SINCE 2006

No College Degree

PROBATION FROM 2002-2005

CONVICTED JULY 26,2005-JUL Y2013

Cause No 07-02-02097CR

ALL STAR TOYOTA AWARDS ARE FOR INTERNET SALES PERSON ONLY!

CLAIM AND FORCED--- 1/2 DEALS CREDITS FROM OTHER INTERNET SALESPERSONS

TO GET AWARDS!

NOT SALESMANAGER POSITIONS AS CLAIMED

Claims Military History - LIE- Complete BS

High school grad - GED

NO COLLEGE DEGREE!

Claims still married but wife Britney Pelton died November 18, 2020

https://www.linkedin.com/in/brad-reynolds-225676217/

https://www.dignitymemorial.com/obituaries/tyler-tx/brittany-pelton-9911141

Currently engaged as of 9/10/2022

https://www.linkedin.com/pub/dir/Bradford/Reynolds

https://www.facebook.com/BHR40

Brad Reynolds (@tiderider51) / Twitter

https://twitter.com › tiderider51

Brad Reynolds now claims to have received an offer from the University of Arkansas.

This latest assertion appears to be a lie!

Brad Reynolds now claims to have returned to the University of Louisville to play his final year under Head Coach Jeff Brohm Go Cards

Brad Reynolds is now claiming that the reposted square profile picture from Acc Football (@accfootball)

This latest assertion appears to be a lie!

Brad Reynolds is now claiming that the reposted square profile picture from Acc Football (@accfootball)

This latest assertion appears to be a lie!

BRAD REYNOLDS / BRADLEY HOUSTON REYNOLDS

This latest assertion appears to be a lie!

LIE

WAS

Internet/Salesperson

MANAGER

TERMINATED OCTOBER 2021

Brad Reynolds, Continuous

FRAUD,

100% Automotive finance

FRAUD

and

Claimed to work in Canada as

"Business Validation Officer"

MANY FRAUDULENT LISTINGS

to cover up his criminal

Indictments

CALL

Canada Revenue Agency !

Reference Case # 3913931

1-866-809-6841

"NO"

BRAD REYNOLDS, BRAD H REYNOLDS, BRAD HOUSTON REYNOLDS, BRADLEY

HAS EVER WORKED FOR CANADA REVENUE AGENCY!

ONE OF HIS MANY FRAUDULENT LISTINGS

to cover up his criminal indictments

Bradley Reynolds - Canada Revenue Agency

https://ca.linkedin.com › bradley-reynolds-5b003112b

Additional potential victims

of

Bradley Houston Reynolds

( AKA)

BRAD REYNOLDS

Links Below:

Some links listed below have been removed

https://www.instagram.com/tiderider51/

Brad Reynolds (@tiderider51) • Instagram photos and videos

srmartin01@gmail.com

tiderider51 Now claiming he is a football player!

Removed

Brad Reynolds (@tiderider51) / Twitter

https://twitter.com › tiderider51

https://unmask.com/Bradley-Reynolds/2/

Brad Reynolds (@tiderider51) / Twitter

https://mobile.twitter.com › tiderider51

https://twitter.com/tiderider51/with_replies

https://www.facebook.com/BHR40

https://twitter.com/tiderider51/status/757235781438050304

https://www.dsmtuners.com/threads/for-people-who-think-im-selling-my-car-imposter.191529/

https://rotarycarclub.com/rotary_forum/showthread.php?s=a8008c978ca7f381ac2155d7004c120a&t=18086

https://www.smartbackgroundchecks.com/people/brad-

Reynolds/El04ZwZ3ZQxjBQLkZmpjBGL2AGVm

The warning signs of employee fraud

https://www.aicpa.org/resources/article/the-warning-signs-of-employee-fraud

https://checkr.com/blog/background-check-for-financial-servic

Brad Reynolds (@tiderider51) · Twitter

https://twitter.com/tiderider51

Just got our tickets for the Kickoff game in Georgia! Behind the visitors bench! Bringing the whole family, so we're stoked! Would love to meet and get a pic with @AshtonGillotte @PierceClarkson_ @moneymannquann @ahmari_huggins @JoshMinkinsJr 7/11/2023

fubreynolds61@ix.netcom.com

srmartin01@gmail.com

Bradley H Reynolds does not have a college degree,

Had his name put on a apartment lease,

Establish multiple phone numbers,

Never attended Lone Star Collège

Lone Star College refunded his class deposit money, Year 2006

Was in custody for other crimes from 2004-2005 for 445 day.

Went to prison in 2006 -2014

https://www.bbb.org/us/tx/manvel/profile/new-car-dealers/keating-

toyota-0915-90061054/customer-reviews

Is this pattern of deception and fraud common practice in other Keating stores?

BELOW

KEATING TOYOTA COMPLAINTS

"Since January 2021, the BBB of Greater Houston & South Texas has received several complaints and customer reviews on Keating Toyota that exhibit the following pattern.

According to the consumer’s disputes, it is being alleged that Keating Toyota advertises a low price online, but when the consumer gets to the dealership, the price is higher. Consumers are also reporting that the dealer is including add-ons during the financing phase without their prior knowledge. Even when the consumers stated they do not want additional dealer add-on, they are still being included on the contract. Some consumers are reporting that they are unsuccessful in reaching the finance department to cancel warranties and add-ons".

https://www.youtube.com/watch?v=YKGfYYBpVxw

https://www.youtube.com/watch?v=3K0rxzWXBys

https://www.yelp.com/biz/victoria-dodge-victoria

BELOW

Keating Toyota scammed my elderly parents

43,618 Views | 219 Replies | Last: 2 mo ago by GrimesCoAg95

https://texags.com/forums/46/topics/3272009

"TLDR; In my opinion, Keating Toyota in Manvel scammed my almost 80 year old parents of almost 20k

My Senior parents had been looking for a minivan (Sienna). Found one online at Keating and agreed to price on email. They arrived at the dealership and were given the classic bait and switch We just sold it 5 minutes ago". They then convinced them that they could get one in the dealership the next day. Claimed it just happened to be coming in.

They agreed on a price that seemed reasonable. They came back the next day and went over the numbers. Everything seemed correct and in order. They were taken to the typical finance upsell foolishness. Refused the add ons. The paperwork was all on an in desk computer screen. The finance guy said he written numbers they agreed on would just be input into the computer. They weren't shown any new numbers on the screen and assumed it was the same as the paper they had been looking at because that is what they were told. They were not shown any changes on the computer screen. They signed it electronically. My dad asked for copies of what they signed. They refused and said they were only allowed to put the paperwork on a thumb drive.

They left and took the vehicle home. When they opened up the flash drive paperwork, almost 20k of scam warranties, APEX GPS etc had been added on. Unfortunately, they didn't tell me they they were buying the car and I was caught off guard by this level of brazen fraud. Preying on elderly folks like this is beyond the pale and makes me sick to my stomach.

Looking at online reviews, this seems to be a common scam they are running. Naturally they are refusing to talk to them or return calls etc. What recourse do they have here? Complaint to AG? Anyone experienced similar with elderly parents? "

https://texags.com/forums/46/topics/3272009

"Wow,

I didn't realize Keating was an Aggie. Makes this situation even more disgusting.

https://www.yelp.com/not_recommended_reviews/keating-toyota-manvel

Seems like what they did to my parents is a common scam they are running. Many of the Yelp stories are quite similar. Not sure how this is allowed to continue in the state. Truly dishonorable.

Retained a lawyer on their behalf today. They are filing a police report.

Making complaints to:

Texas AG office

Texas DMV

Texas Office of Consumer Credit."

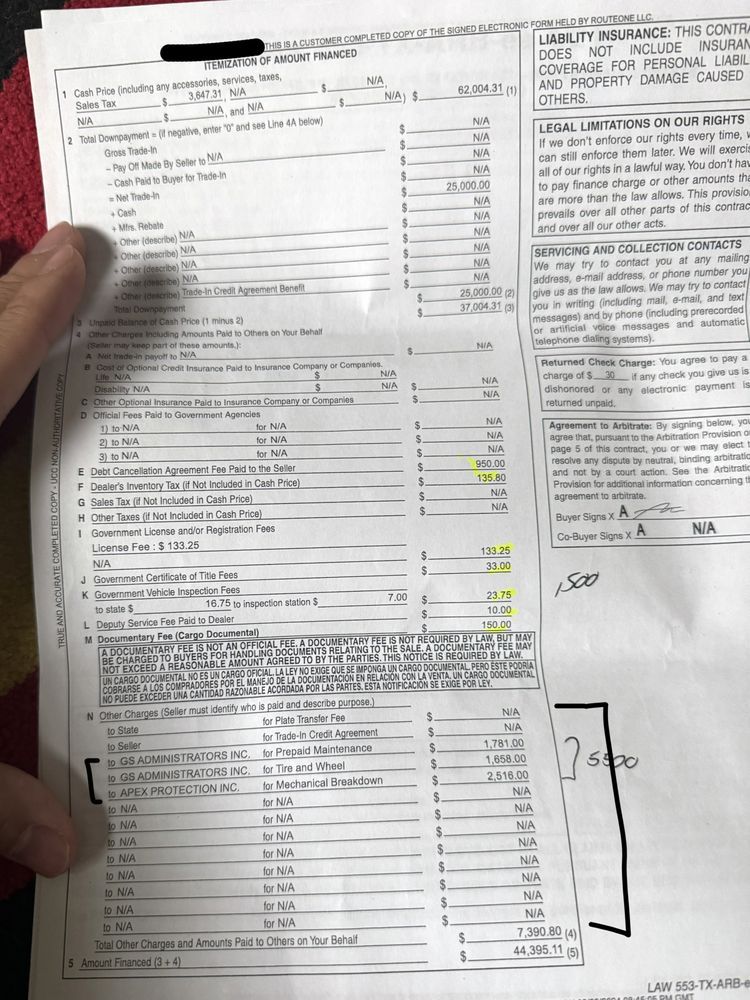

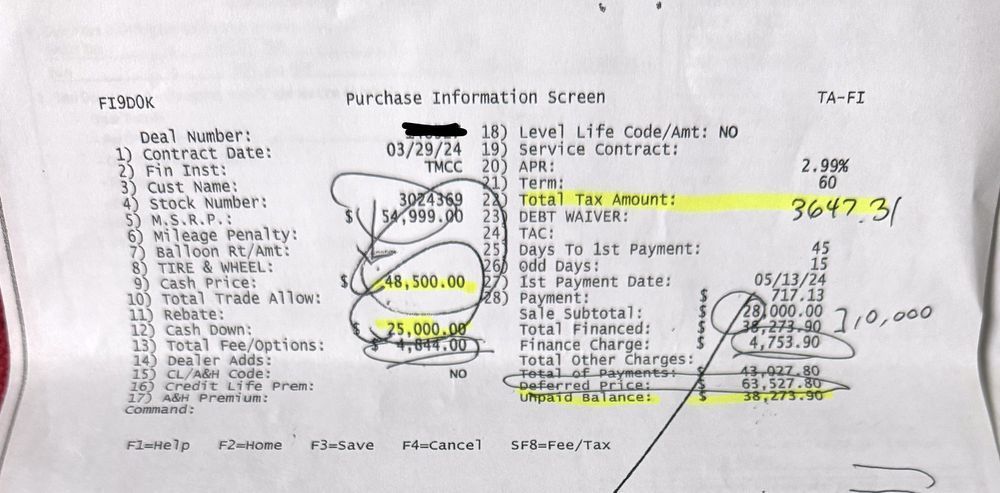

Below Fraudulent Payment Menu

Packed with forced

Optional Aftermarket Products

with no option offered to customer to decline. FRAUD

DISCLOSURE CLAIMS:

SELLING PRICE $48,500.00 SELLING PRICE

https://www.yelp.com/biz/keating-toyota-manvel?start=90

$ 25,000 down payment by this fraudulent menu showing NO Cost for all of the aftermarket optional products offered! Reference top of page $48,500 less 25,000 down payment, + includes only fees of $350.00 and Taxes $3,167.05 Where is the option to decline all Optional products and where is the true payment for purchase with out any optional products and additions taxes added.

100% FRAUD

REFERENCE BELOW THE BUYERS PURCHASE ORDER:

$1884.00 WINDSHILD PROTECTION ( ALL OF THESE PRODUCTS ARE TAXABLE)

$1880.00 PAINT PROTECTION ( ADDITION TAX FOR THESE PRODUCTS CHARGED $ 479.81 )

$1780.00 DENT REPAIR

$4313.00 APEX GPS

______________________________

$10.00 DLR DEPUTY FEE ( ALL OF THESE ITEMS ARE LISTED AS NON TAXABLE)

$190.00 ST INSP, TITLE, LIC FEE

$150.00 DOCUMENTARY FEE

$135.80 DEALER INVENTORY TAX

$950.00 GAP INSURANCE

TOTAL FINANCE AMOUNT OF : $44,395.11 (DOES NOT SHOW ON MENU OFFERED) .

STAMPED SIGINATURE FOR MULTIBLE PRODUCTS FRAUD !

https://www.yelp.com/biz/keating-toyota-manvel?start=90

Fraudulent Vehicle Sales on the Internet

Consumers should be aware that criminals may publish false online classified ads offering vehicles for sale that are not, and have never been, in their possession.

The fraudulent ads frequently include images that match the vehicle description and a phone number or e-mail address for contacting the alleged vendor. Once contact has been established, the criminal sends further images to the intended buyer, along with an explanation of the lowered price and the transaction's urgency. The following are some of the most common explanations given:

The seller is relocating or serving in the military.

The automobile was part of a divorce settlement for the seller.

The vehicle belonged to a deceased relative.